Applying for an education loan in India can often feel overwhelming. With multiple steps – ranging from meeting eligibility criteria to completing the documentation, securing loan approval, and finally, receiving the funds is not easy – students and parents can find the process difficult. Understanding these steps, including the intricacies of loan sanctioning and disbursement, is crucial for a seamless experience. During this process, one of the most critical yet misunderstood components of the student loan process is the sanction letter.

What is a Student Loan Sanction Letter?

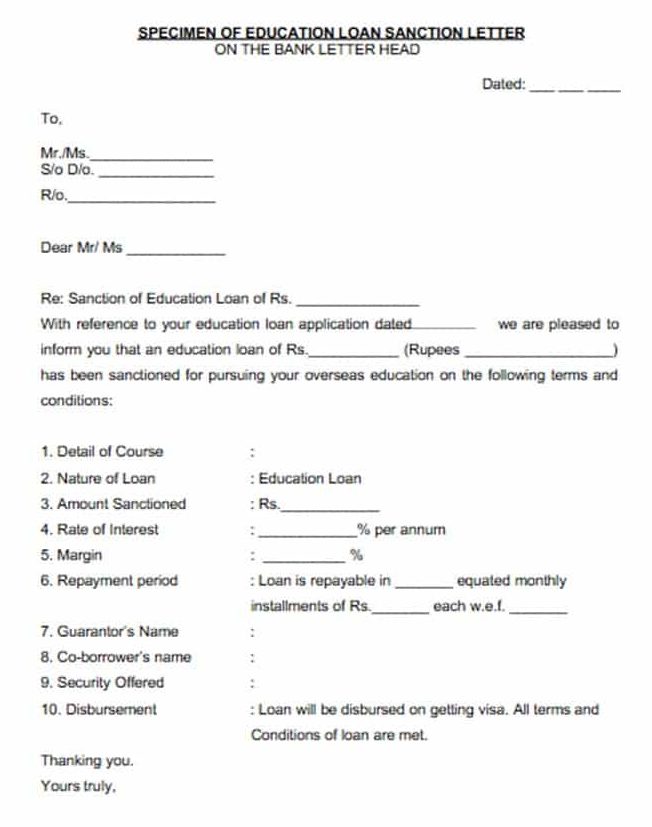

Student Loan Sanction Letter is an official document issued by a bank or financial institution which confirms the approval of a student loan. This letter serves as proof that the applicant has met all the required eligibility criteria and that the lender has agreed to provide them an education loan. The student loan sanction letter outlines the sanctioned loan amount, interest rate, repayment terms, moratorium period, and other essential conditions.

It is a very important document for the students, especially those who are planning to pursue studies abroad. Many universities require proof of financial support during the admission or visa application process. Generally, banks issue a conditional or unconditional sanction letter. A conditional sanction letter refers to the document that signifies that the education loan approval is subject to fulfilling certain requirements, such as submitting additional documents or collateral. On the other hand, an unconditional sanction letter confirms final loan approval without further conditions.

However, receiving the loan sanction letter does not mean immediate loan disbursement. The sanctioned amount is disbursed in installments based on the requirement of the academic institution.

Key Details included in a Student Loan Sanction Letter

A student loan sanction letter contains the below information:

| Category | Details Included |

| Basic Information | – Borrower’s name and address

– Loan account number – Date of issuance – Co-applicant’s name (if applicable) |

| Loan Details | – Type of loan (e.g., home loan, business loan, education loan)

– Loan amount sanctioned – Loan tenure (duration for repayment) – Purpose of the loan (if applicable) |

| Interest Rate & Charges | – Type of interest rate (fixed/floating)

– Annual Percentage Rate (APR) – Processing fees and other charges – Prepayment and foreclosure charges (if applicable) |

| Repayment Terms | – Equated Monthly Installment (EMI) amount

– Mode of payment (e.g., bank transfer, ECS, NACH) – Repayment schedule – Moratorium period (if applicable) |

| Collateral & Security (if applicable) | – Details of pledged assets such as property, fixed deposit, securities, etc.

– Guarantor details (if required) – Insurance requirement (if applicable) |

| Conditions Precedent | – Submission of required documents such as KYC, income proof, property documents, etc.

– Compliance with lender’s terms before disbursement |

| Other Terms & Conditions | – Disbursement policies

– Legal clauses (loan default consequences, arbitration clause) – Validity period of the sanction letter |

| Authorization & Acceptance | – Signature of the lender’s authorised representative

– Borrower’s acceptance (signature) – Official stamp/seal of the lender |

Types of Student Loan Sanction Letter

Education loan sanction letters can vary depending on the type of loan scheme, issuing bank or lender, and other related requirements. Here are the common types of student loan sanction letters:

| Type of Sanction Letter | Definition | Issued When | Usage | Validity | Key Features |

| Provisional | Preliminary approval, subject to fulfilling specific conditions. | Student applies but has not completed all formalities (document verification, collateral submission, co-borrower approval). | University admission confirmation, visa processing (in some cases). | Temporary, typically a few months. | Confirms eligibility, but not a guarantee of disbursement. |

| Conditional | Issued with conditions that must be met before final disbursement. | Student needs assurance of loan approval but has pending formalities. | Provides conditional approval, outlining required steps. | Until conditions are met. | Lists specific requirements for final approval (e.g., missing documents, visa approval). |

| Final (Confirmed) | Issued when all requirements are met and loan is fully approved. | All documents verified, collateral approved, and the applicant meets all conditions. | University admissions, visa applications, loan disbursement. | Usually until loan repayment is complete. | Includes loan amount, interest rate, repayment terms, borrower/co-borrower details, collateral details, fees, etc. |

| Collateral-Based | Issued when the loan is secured by collateral. | Loan amount is large (typically above ₹7.5 lakh domestic, ₹20 lakh abroad). | Securing large loan amounts, often with lower interest rates. | Until loan repayment is complete. | Higher loan amount, lower interest rates, requires property verification and legal compliance. |

| Non-Collateral (Unsecured) | Issued for loans without collateral. | Applicant has strong academic record, attends a good university, and/or has a strong co-borrower. | Students without assets to pledge as collateral. | Until loan repayment is complete. | Based on merit and co-borrower profile, higher interest rates than collateral-based loans. |

| Pre-Visa | Issued to help students obtain a study visa. | Required for visa applications in certain countries (e.g., USA, Canada, Germany, Australia). | Demonstrating financial stability to immigration authorities. | Varies, often linked to visa application timeline. | Helps secure study visa, may be required for specific financial arrangements (e.g., blocked account, GIC). |

| Bank Guarantee-Based | Loan backed by a bank guarantee from a guarantor. | Student have low credit scores or unstable financial history, loan exceeds standard limits. | Securing loans when the applicant’s financial profile is weak. | Until loan repayment is complete. | Requires a guarantor with a strong financial background. |

| Skill-Based Courses | Issued for short-term skill-based or vocational courses. | Student is enrolling in a diploma, vocational, or certification course. | Financing skill development and vocational training. | Until course completion and potentially a short repayment period. | Lower loan amounts compared to degree programs. |

| Government Subsidy Schemes | Issued for government-backed loans with interest subsidies. | Student qualifies for a government subsidy scheme (e.g., Padho Pardesh, Dr. Ambedkar Interest Subsidy Scheme, CSIS) | Benefitting from government interest subsidies | Until loan repayment is complete | Offers subsidized interest rates to eligible students |

Also Read: Documents Required for an Education Loan – An Extensive List

Documents Required for Sanction Letter

The documents to obtain the education loan sanction letter varies on the lender’s requirements. Below is the general list of documents to be submitted while applying for a student loan sanction letter:

1. Documents Required From Applicant:

- Duly filled education loan application form

- Passport-size photographs

- Identity proof such as PAN Card, Passport, Voter ID card, etc.

- Address proof such as a recent copy of telephone bill, electricity bill, or water bill, etc.

- Copy of the passport

- Academic transcripts such as Class 10, 12, or Graduation marksheet/ certificates

- Scorecards of entrance tests like GRE, TOEFL, IELTS, etc.

- Admission letter or conditional admission offer letter (if applicable)

- Statement of expenses for the entire cost of education

- Loan account statement of one year, if there are any previous loans taken from any lender

2. Documents Required From Co-Applicant:

- Identity proof such as PAN Card, Passport, Voter ID card, etc.

- Address proof such as a recent copy of telephone bill, electricity bill, or water bill, etc.

3. Income proof:

- For self-employed co-applicants:

- Business address proof

- Last 2 year’s Income Tax (IT) returns

- TDS Certificate

- Certificate of Qualification

- Bank account statement of the last 6 months

- For salaried co-applicants:

- Salary slips for the last 3 months

- Copy of Form 16 for the last 2 years or copy of IT Returns for the last 2 years.

- Bank account statement for the last 6 months.

Applicants will have to submit collateral documents along with the above-mentioned documents in case the student has applied for a secured education loan.

- A good CIBIL score of the co-applicant and a good GRE score of the applicant can expedite the student loan approval process.

How to get a Student Loan Sanction Letter?

The timeline and process to receive an education loan sanction letter vary based on the lender, the type of loan or grant, and the accuracy of information provided in the loan application. Below is detailed information on how and when you can expect to receive a sanction letter. The students are required to follow the below steps to obtain a student loan sanction letter:

- Application Submission: Applicants must complete a student loan application form, providing detailed personal, financial, and employment information. This often includes details about the desired loan (amount, purpose, etc.).

- Document Collection: Applicants will be required to provide various documents such as identity proof (Aadhaar, Passport, Voter ID, etc.), address proof (utility bills, Aadhaar, Passport, etc.), and income proof (salary slips for salaried individuals, ITR returns for self-employed individuals, bank statements, etc.). If the education loan requires collateral, property ownership documents must also be submitted. Additionally, lenders may request other relevant documents, such as educational certificates for education loans or business registration documents for business loans.

- Loan Processing: Lenders review the student loan application form along with the provided supporting documents which includes verifying the information, assessing the applicant’s creditworthiness to verify the credit score check, and evaluate the collateral offered (if any). Some of the lenders may also conduct a personal interview with the applicant.

- Loan Approval: If the provided information and documents are accurate then the education loan will be approved.

- Sanction Letter Issuance: Once the student loan is approved, the lender will issue a student loan sanction letter.

- Acceptance of Terms: After receiving the education loan sanction letter, the applicants are advised to carefully review all the terms and conditions in the sanction letter for the loan. If the applicant agrees with them, they must sign and return a copy of the education loan sanction letter to the lender as acceptance.

- Disbursement: After the applicant accepts the terms and completes any remaining formalities which includes submission of any pending documents, payment of processing fees etc., the loan amount will be disbursed to the respective bank account of the applicant.

Also Read: Education Loan Eligibility Criteria – Complete Guide for Students

FAQs

What is a Student Loan Sanction Letter?

A student loan sanction letter is an official document issued by a bank, financial institution, or NBFC confirming the approval of an education loan. It outlines key details such as the sanctioned loan amount, interest rate, repayment tenure, moratorium period, and conditions for disbursement. This letter serves as proof of financial support and is often required for university admission or visa applications.

What information does a Student Loan Sanction Letter contain?

A sanction letter typically includes the approved loan amount, interest rate (fixed or floating), loan tenure, EMI details, moratorium period, security or collateral requirements (if applicable), co-borrower details, processing fees, and terms for disbursement. Some lenders may also mention special conditions like insurance coverage or specific repayment clauses.

What is the validity period of the sanction letter?

Most banks provide a validity period of 3 to 6 months from the date of issuance. If the loan is not availed within this period, the applicant may need to reapply or request an extension, subject to the lender’s discretion.

Is the sanction letter the final loan approval?

No, the sanction letter is a provisional approval, meaning the loan is approved in principle but is subject to fulfilling all conditions mentioned in the letter. The final disbursement happens only after all required documents are verified, and any necessary collateral or guarantees are secured.

How long does it take to receive a sanction letter?

The processing time for a student loan sanction letter varies across banks and lenders but generally takes between 7 to 21 days after submitting a complete loan application along with all required documents. Delays may occur if additional verification or collateral evaluation is needed.

What are the eligibility criteria to get a student loan sanction letter?

Eligibility depends on factors such as admission to a recognized institution, the student’s academic performance, the financial standing of the co-borrower (if required), and the presence of collateral (for secured loans). Lenders also evaluate the applicant’s and co-applicant’s creditworthiness before granting loan approval.

Do I need to submit collateral for getting a sanction letter?

For unsecured education loans, collateral is not required, but the loan amount is usually capped based on the lender’s policy. For secured loans, banks may ask for collateral such as property, fixed deposits, or third-party guarantees, especially for higher loan amounts.

Can I request modifications in the sanction letter?

Yes, applicants can request modifications, such as an increase or decrease in the loan amount, changes in tenure, or adjustments to the interest rate. However, these changes are subject to the bank’s policies and additional verification.

Can I use the sanction letter to obtain a visa?

Yes, for overseas studies, many embassies, including those of the USA, Canada, and Germany, accept a sanctioned education loan as valid proof of financial capability when processing student visa applications.

Will I receive a sanction letter for an education loan before admission?

Some banks provide pre-admission sanction letters based on the applicant’s academic profile, entrance test scores, and admission likelihood. This helps students secure admission by demonstrating financial backing to universities or embassies.

What happens if my sanction letter expires before my admission or visa process?

If the sanction letter expires, students can request an extension from the bank. The lender may ask for updated financial documents before reissuing the letter. If the loan structure changes significantly, a fresh application may be required.

How can I check the status of my student loan sanction letter?

Applicants can check their loan status through the bank’s online portal, by visiting the branch, or by contacting their assigned loan officer. Some banks also provide SMS or email updates regarding loan application progress.

Is a co-borrower necessary for the sanction letter?

Most banks require a co-borrower, such as a parent, guardian, or spouse, for education loans, especially for unsecured loans. The co-borrower ensures financial backing and is responsible for repayment in case the borrower is unable to pay.

What are the common reasons for education loan sanction letter rejection?

Rejections can occur due to poor credit history of the applicant or co-applicant, incomplete or inaccurate documentation, admission to an unrecognized institution, insufficient co-borrower income (for unsecured loans), or inadequate collateral (for secured loans).

Can I get a student loan sanction letter without income proof?

For secured loans, banks may not strictly require income proof from the co-applicant if sufficient collateral is provided. However, for unsecured loans, a co-borrower’s income proof is usually mandatory to ensure repayment ability.

What should I do after receiving the sanction letter?

After receiving the sanction letter, applicants should carefully review all terms, sign and return the letter (if required), complete any pending documentation, and use it for university admission or visa processing. They should also ensure they meet all conditions for loan disbursement.

Can I cancel my sanctioned education loan?

Yes, borrowers can cancel their sanctioned loan before disbursement without any penalties in most cases. However, some banks may charge a processing fee if the loan application is withdrawn after approval.

Is the interest rate mentioned in the sanction letter final?

The interest rate mentioned in the sanction letter is generally final, but if it is a floating rate loan, it may be subject to market fluctuations. Applicants should clarify whether their loan has a fixed or floating interest rate.

What happens after the loan is sanctioned?

Once the loan is sanctioned, the applicant must submit additional documents such as the admission letter, fee structure, and any pending verification details. The loan amount is then disbursed directly to the university or institution in installments. Repayment typically starts after the moratorium period, which usually includes the course duration plus a grace period of 6 months to a year after course completion.

How do I request a duplicate copy of my sanction letter?

Applicants can request a duplicate copy of their sanction letter by visiting the bank branch, sending a written email request, or checking if it is available for download on the bank’s online loan portal.