Are you looking for the right education loan to fund your higher education dreams? Let us introduce you to the Cent Vidyarthi Scheme by CBI. Whether you aspire to study abroad or within India, this loan can turn your academic aspirations into reality. With a maximum loan amount of up to ₹2 crores, no course will be out of reach for you. You can do MBBS, BTech, PhD, MBA, and other courses using this study loan. Cent Vidyarthi Scheme provides you with a moratorium period of one year after the completion of your course so that you can peacefully focus on getting a job and repay the loan later. Below, we have discussed all there is to know about the Central Bank of India’s Cent Vidyarthi Scheme. Learn about the loan amount, interest rate, repayment information, collateral needed, eligibility criteria, and much more.

Cent Vidyarthi Education Loan – Highlights

| Particulars | Details |

| Name of the Scheme | Cent Vidyarthi |

| Provider | Central Bank of India |

| Official Website | centralbankofindia.co.in |

| Beneficiaries | Indian citizens with confirmed admission to recognized institutions for professional/technical courses are eligible. This includes newly admitted students and those who intend to pursue higher qualifications while employed. |

| Benefits | Educational loans up to ₹2 crore |

| Maximum rate of interest | 10.35% |

| Application Mode | Online/offline |

| Loan Repayment Starts | One year after course completion |

| Loan Repayment Period | 15 years |

Cent Vidyarthi Scheme Eligibility Criteria

To be eligible for the scheme, students must meet the below-mentioned criteria:

- The applicants must be Indian nationals.

- Candidates should have secured admission to a higher education course in recognized institutions in India or abroad.

- Admission should be based on an entrance test or a merit-based selection process after completing Class 12 or an equivalent qualification.

CBI Education Loan – Cent Vidyarthi Benefits

The Cent Vidyarthi education loan scheme by CBI offers student loans for up to ₹2 crores. Applicants can get this loan to study in India and abroad. It is important to keep in mind that the loan amount that you need will need to be justified. For example, if you need ₹10 lakhs loan and you can show that your course fees plus hostel rest is ₹10 lakhs, then the bank will not oppose it. However, you can not say that your course fee is just ₹8 lakhs, and you need an extra ₹2 lakhs as backup money for emergencies. You can learn about the costs that the Cent Vidyarthi loan covers by reading below.

Expenses Covered under Cent Vidyarthi Education Loan

The loan amount can cover the following educational expenses:

- College course, hostel, and mess charges

- Extra fees that are charged to the student by the college, such as examination/library/laboratory fee

- Daily travel expenses and flight costs for studies abroad

- Health or life insurance premium for students, if applicable

- You can ask for a loan amount to pay the caution, building fund, or refundable deposit asked by the institution.

- Money is required to purchase books, equipment, instruments, and uniforms required for course completion.

- Purchase of computer at a reasonable cost, if mandated for course completion.

- Any other expenses related to the course, such as study tours, project work, thesis, etc.

Also Read: Factors to Consider Before Applying for an Education Loan

Cent Vidyarthi Scheme Margin Amount

The margin amount is the charge that the bank deducts from the loan amount before crediting it to the applicant’s account. This procedure is conducted to demonstrate the student’s commitment to paying the study loan. For the Cent Vidyarthi Scheme, the margin amount depends on the total loan amount. Candidates must fulfil the following margin as per the percentages mentioned below:

- Up to ₹ 4 lakh – 0% margin money to study in India or abroad

- Above ₹4 lakh – 5% margin money to study in India

- Above ₹4 lakh – 15% margin money to study abroad

CBI Cent Vidyarthi Interest Rate

The interest rate for the Cent Vidyarthi scheme is determined on the basis of the bank’s repo-based lending rate (RBLR), which varies from course to course. For the Cent Vidyarthi loan under the NCGTC Guarantee Scheme, the interest rate is RBLR+1.25%. Students who are pursuing professional courses from the top colleges in India, such as IITs, NITs, AIIMS, IIITs, IIMs, etc., will get a lower interest rate, which is RBLR+0.95%. In addition, if you start repaying your education loan during the moratorium period, then you will have to pay 1% less interest during the moratorium period.

| Loan Criteria Under Cent Vidyarthi | Interest Rate |

| Cent Vidyarthi Loan for education in top-tier management, engineering, or medical institutions abroad under Category D, with collateral security. | RBLR+0.95%

Currently, it is 10.05%* |

| Cent Vidyarthi Loan under NCGTC Guarantee Scheme | RBLR+1.25%

Currently, it is 10.35%* |

Note: Keep in mind that the current rate mentioned in the table will change when the rate of RBLR changes.

Also Read: Education Loan with Low Interest Rate

CBI Cent Vidyarthi Scheme Participating Institutions

The Cent Vidyarthi education loan scheme partners with prestigious management, medical, pharmacy, and engineering colleges, which include:

AAA Institutions (Premier Management Institutes):

- IIM Ahmedabad

- IIM Bangalore

- IIM Kolkata

- IIM Indore (Including Mumbai Campus)

- IIM Kashipur

- IIM Kozhikode

- IIM Lucknow

- IIM Raipur

- IIM Ranchi (Including Hyderabad Campus)

- IIM Rohtak

- IIM Shillong

- IIM Trichy

- IIM Udaipur

- IIM Indore (IPM & similar programs)

- IIM Nagpur

- IIM Amritsar

- IIM Bodhgaya

- IIM Sirmaur

- IIM Visakhapatnam

- IIM Sambalpur

- IIM Jammu

- NITIE Mumbai (Now IIM Mumbai)

- XLRI Jamshedpur & Jhajjar

- MDI Gurgaon

- ISB (GP & PGP-Pro)

- IIFT (MBA in IB & Business Analytics)

- IIT Madras

- IIT Delhi

- IIT Bombay (SJSOM)

- IIT Kanpur

- IIT Roorkee

- IIT Kharagpur

- IIT Hyderabad

- IIT Ropar

- IIT Bhubaneswar

- IIT Jodhpur

- IIT Jammu

- IIT Bhilai

- IIT Goa

AA Institutions (Premier Management & Other Institutes):

- XIMB Bhubaneswar

- XSHRM, XUB Bhubaneswar

- XSRM, XUB Bhubaneswar

- SPJIMR Mumbai

- IIT Guwahati

- IIT Indore

- IIT BHU Varanasi

- IIT ISM Dhanbad

- IIT Gandhinagar

- IIT Mandi

- IIT Patna

- IIT Tirupati

- IIT Palakkad

- IIT Dharwad

- FMS Delhi

- JBIMS Mumbai

- NMIMS Mumbai

- IRMA Anand

- IIFM Bhopal (PGP/MBA)

- SCMHRD Pune

- SIBM Pune

- IMT Ghaziabad

- IMT Hyderabad

- IMT Nagpur

- BIM Tiruchirapalli

- TAPMI Manipal

- NIFT Delhi

AA Institutions (Premier Medical Colleges):

- AIIMS & All Govt. Colleges

- Grant Medical College Mumbai

- Madras Medical College Chennai

- SRM Medical College Kattankulathur

- KGMU Lucknow

- CMC Vellore

- NIMHANS Bangalore

- BHU Varanasi

- JIPMER Puducherry

- PGIMER Chandigarh

- Kasturba Medical College (Manipal, Mangalore)

- SGPGI Lucknow

- SCTIMST Trivandrum

- ILBS Delhi

- St. John’s Medical College Bangalore

A Grade Institutions:

- BITS Pilani

- BITS Goa

- BITS Hyderabad

- IICA Manesar

- MIT Manipal

- Nirma University Ahmedabad

B Institutions:

- ACDS Secunderabad

- ACMS Delhi

- AIL Mohali

- AIM Kolkata

- AIT Pune

- BIT Mesra Ranchi

C Institutions:

- CEPT Ahmedabad

- CIMP Patna

- NIT Jalandhar

D Institutions (Global Top Universities):

- Harvard University

- University of Oxford

- Stanford University

- University of Cambridge

- MIT Cambridge

- Columbia University

- INSEAD Paris/Singapore

- LBS London

- Nanyang Tech University

- ETH Zurich

- Caltech Pasadena

- Tsinghua University

- EPFL Lausanne

- Delft University

- UCLA

Cent Vidyarthi Scheme Application Process

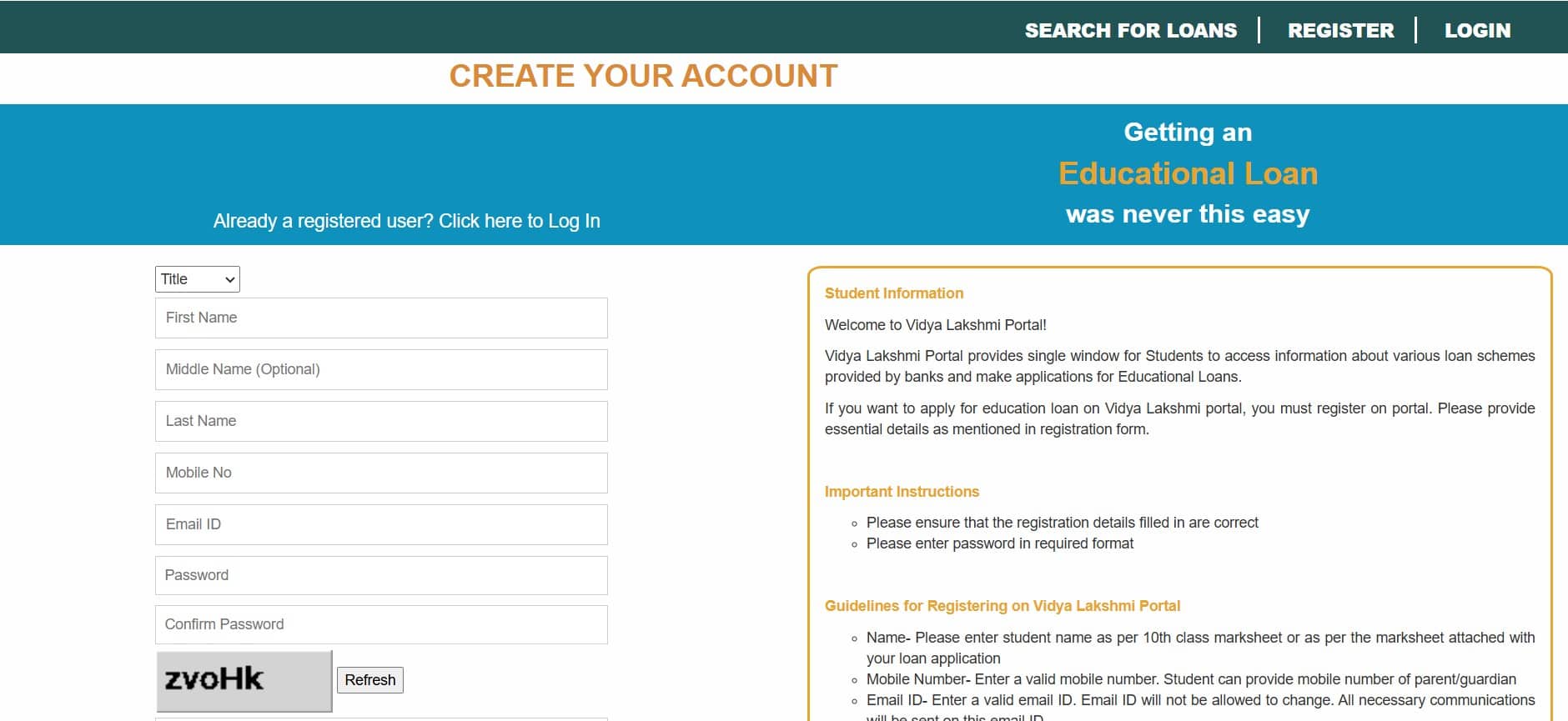

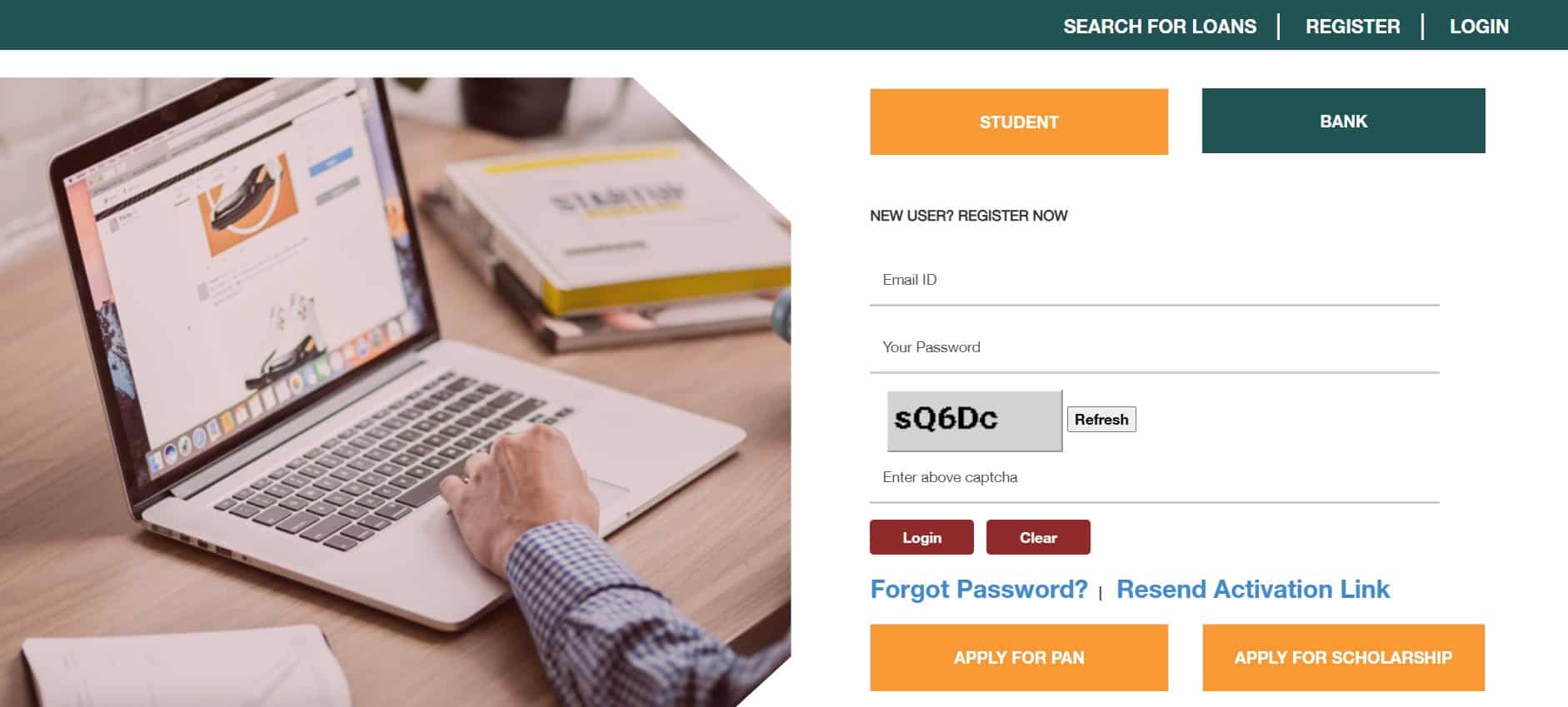

Interested and eligible students can apply for the Cent Vidyarthi loan offline and online. For the online process, the applicant needs to visit the official PM Vidyalakhshmi Portal. Detailed steps for the application process are provided below.

Cent Vidyarthi Scheme Online Application Process

Step 1) Visit the Vidya Lakshmi portal to fill out the common application form for the Cent Vidyarthi education loan scheme.

Step 2) Click on the register tab or the apply now button and fill out the required details to create an account.

Step 3) After submitting the details, click the ‘Student Login’ tab and enter the registered email ID, password, and captcha code.

Step 4) Now fill in the details like your course details, personal details, educational qualifications, co-signer details, income certificates, etc.

Step 5) Now choose the Central Bank of India Cent Vidyarthi Scheme from the list of education loan schemes available.

Step 6) Apply for the loan and wait for the bank to review your application and process the loan amount.

Also Read: Study Loan Process: Eligibility, Application, & More

Offline Application Process for Cent Vidyarthi Scheme

- Visit the nearest branch of the Central Bank of India and request the application form or download the PDF from their official website.

- Fill out the application form and ensure that you provide accurate and complete information.

- Ensure you attach all the required documents, including proof of income, academic certificates, admission letter, fee structure, and other relevant documents.

- Visit the CBI branch and approach the designated loan officer or staff to submit the education loan application.

- Suppose the application meets the bank’s criteria and passes the underwriting process. In that case, candidates will receive a loan sanction letter specifying the approved loan amount, interest rate, repayment terms, and other relevant details.

- Once the loan is sanctioned, the amount will be credited to the college’s account.

Also Read: Education Loan Application Form

Documents Required for Cent Vidyarthi Education Loan Application

Students who have not applied for an education loan often make mistakes in the document submission step, costing them their education loan. To avoid such a disaster, it is important to keep a copy of all the required documents, which are mentioned below.

- Authentic admission letter from a recognised college or university.

- Proof of ownership of an asset as collateral

- Proof of salary or income is needed, so attach the ITR of two previous financial years, salary slips, and bank statements.

- Entrance exam score or merit list posted by the college.

- Previous educational qualifications such as class 10 & 12 mark sheets.

- Payment slips of any premium paid towards insurance.

Also Read: Documents Required for an Education Loan – An Extensive List

CBI Cent Vidyarthi Loan Disbursement Details

Students who apply for an education loan do not get the money in their account once the loan is approved. Since it is an education loan, the amount will be credited to the college’s account, against which the college will reduce your course fees or make it zero. If you have asked for a loan to pay the hostel fees, they will be credited to your hostel provider’s account directly. Keep in mind that, in any case, you need to submit the original receipts of the bill payment to the bank.

Cent Vidyarthi Loan Repayment Details

The Cent Vidyarthi loan repayment starts after the moratorium period ends. This means students will have the course duration and one extra year to prepare for education loan EMI payment. A maximum of 15 years is given to students to repay the loan, and they can adjust their EMIs accordingly.

Also Read: Education Loan Repayment – Strategies to Repay an Education Loan

Cent Vidyarthi Education Loan Summary Points

- You will receive the entire loan amount upfront.

- Students will get this loan only if they provide supporting documents justifying their request.

- Cent Vidyarthi moratorium period is course duration + one year.

- The repayment period for the loan is a maximum of 15 years.

- Payments to the students will be made directly to their college, hostel, mess, or airlines (if required).

- For loans up to ₹7.50 lakhs, it is guaranteed under the NCGTC Guarantee Scheme.

- For loans more than ₹7.5 lakhs, parents or guardians must be joint borrowers, and an equal value of collateral is needed.

Also Read: Student Loan without Collateral – Eligibility, Key Features & Interest Rates

Cent Vidyarthi Education Loan – FAQs

Q. What is the maximum repayment period for the Cent Vidyarthi education loan?

The repayment period for the loan is a maximum of 15 years. Students can choose to start paying the loan during the moratorium period.

Q. Does the Cent Vidyarthi loan cover expenses for a unique study program that combines multiple disciplines?

Yes, the Cent Vidyarthi education loan can cover expenses for innovative study programs that combine multiple disciplines as long as a reputable institution recognizes the course.

Q. Are there any provisions for applying for the Cent Vidyarthi education loan to pursue vocational training programs?

Yes, students who are enrolled in any online courses or vocational training programs that are recognized and offer valid certification are eligible for this education loan scheme.

Q. Is there any provision for scholarships under the Cent Vidyarthi loan scheme?

Yes, scholarships and fee waivers available to the student borrower can be considered when determining the loan amount.

Q. Are there any requirements for language proficiency tests under the Cent Vidyarthi education loan for studying abroad?

As per the Cent Vidyarthi loan scheme, the requirements of language proficiency depend upon the chosen institution.

Q. What is the maximum loan amount provided under the Cent Vidyarthi Scheme?

Earlier, the maximum loan amount was ₹20 lakhs, but it has been now increased to ₹2 crore for loans under the Cent Vidyarthi Scheme by CBI.

Q. Is collateral needed for the Cent Vidyarthi Scheme loan?

Yes, collateral is needed if you apply for an education loan of ₹7.5 lakhs or more under the Cent Vidyarthi Scheme. The collateral value must be equal to the loan amount.

Q. What is the interest rate for the Cent Vidyarthi Scheme loan?

Cent Vidyarthi Loan interest rate for education in top-tier colleges with collateral is RBLR+0.95%. Meanwhile, for the Cent Vidyarthi Loan under the NCGTC Guarantee Scheme, the interest rate is calculated by adding the RBLR+1.25%.

Q. What are the benefits of Cent Vidyarthi?

Students can get loans for study in India and abroad under the Cent Vidyarthi Scheme by CBI. Also, the maximum loan amount is ₹200 lakhs, and you can get 100% financing for your education.

Q. How do you apply for the Cent Vidyarthi loan?

You can apply for the Cent Vidyarthi education loan online and offline. For online visit the PM Vidyalakshmi portal, and for offline process, visit your nearest CBI branch.