In today’s competitive educational landscape, it is very difficult to access quality education and often hinders the availability of financial assistance. The Bank of India Education Loan programs appear as a significant facilitator for students who aim to pursue academic excellence. However, with high tuition fees and related expenses, students find themselves at a crossroads—struggling to make their financial aspirations achievable. These education loan programs by Bank of India Education are designed to empower students by providing flexible financial solutions, competitive interest rates, and seamless application process.

Below article will walk you through the detailed information related to the loan schemes provided by the Bank of India.

Star Education Loan – Studies in India

This student loan scheme offers several advantages and makes it an attractive option for students who are willing to pursue higher studies in India. This scheme offers no documentation charges, no hidden costs, and no prepayment penalties to ensure a hassle-free borrowing experience. Furthermore, there are no processing charges, and no collateral security is required for education loans up to ₹7.50 lakhs. For student loans up to ₹4 lakhs, there is also no margin requirement.

Eligibility Criteria:

- Applicants must be Indian Nationals, Persons of Indian Origin (PIO), or Overseas Citizens of India (OCI).

- They must have secured admission to a recognised institution for courses approved by the University Grants Commission (UGC), Government, or All India Council for Technical Education (AICTE) through an entrance test or a merit-based selection process after completing Higher Secondary Certificate (HSC) i.e. 10+2 or equivalent.

- The course must be approved or recognised by the designated academic authority or regulatory body for the respective field of study in India.

- If admission is not based on an entrance test or merit selection, the education loan may be granted based on the student’s employability and the reputation of the institution.

Expenses Covered:

The following expenses will be incurred under the Star Education Loan – Studies in India by Bank of India:

- Fees payable to college/school/hostel

- Purchase of books/equipment/instruments

- Examination/Library fees

- Purchase of computer/laptop

- Life Insurance Premium for life cover of student/co- borrower for total tenure of loan

- Caution deposit building fund/refundable deposit supported by Institution bills/receipts

- Any other expenses related to education

Note: All student borrowers are provided with an OPTIONAL Term Insurance cover, specifically designed for them, with the premium eligible for inclusion as a financial item.

Interest Rate and Charges

| Loan Amount (in ₹) | Interest Rates |

| For loans up to ₹7.50 lakhs | 1 year RBLR + 1.70% |

| For loans above ₹7.50 lakhs | 1 year RBLR + 2.50% |

There are no processing charges, but there is a Vidyalakshmi portal charge of ₹100.00 plus 18% GST. A one-time fee will be applied for any deviation from education loan scheme norms, including approval of courses outside the scheme as below:

| Scheme Norms | Charges |

| Up to ₹4.00 lakhs | ₹500 |

| More ₹4.00 lakhs & up to ₹7.50 lakhs | ₹1,500 |

| More than ₹7.50 lakhs | ₹3,000 |

Students will be required to pay fees charged by third-party service providers operating the common education loan application portal.

Repayment Period: After the course completion, there will be a one-year grace period (moratorium) before student loan repayments begin. The repayment period itself is 15 years for the Star Education Loan – Studies in India.

Star Education Loan – Studies Abroad

The study abroad education loan offered by the Star Education Loan simplifies financing for higher studies. The prominent features of this student loan include no fees for documentation, hidden, processing, prepayment, no collateral up to ₹7.50 lakhs, and NIL margin up to ₹4.00 lakhs. The online class fees will be covered, and convenient payment options are available.

Education loan transfers will be accepted. This scheme will cover expenses for full-time degree/postgraduate courses in India and abroad, with loan amounts up to ₹150 lakhs for medical (excluding nursing) and non-medical fields, based on the requirements of the student applicants.

Eligibility Criteria

- The education loan scheme is applicable for Indian nationals only.

- They must have secured admission to a recognised institution abroad for approved courses after completing HSC i.e. (10+2) or equivalent.

- In cases where admission is not based on an entrance test or selection based on marks obtained in a qualifying examination, the education loan may be granted based on the student’s employability and the reputation of the institution.

Eligible Courses and Institutions:

- Courses must be approved/recognised by the designated local academic authority/regulatory body for the relevant stream of study.

- Student loans will be considered for study at institutions/universities ranked within the top 3,000 globally (indicative only) as listed on www.webometrics.info OR for study at institutions/universities ranked within the top 1,000 globally (indicative only) as listed on

www.topuniversities.com or www.qs.com

CLICK HERE for the List of Covered Courses

Expenses Covered

Below expenses will be covered under the Star Education Loan – Studies Abroad:

- Fees payable to college/school/hostel

- Examination/Library fees

- Purchase of books/equipment/instruments

- Travel expenses or passage money (one way fare)

- Purchase of computer/laptop

- Caution deposit/building fund/refundable deposit supported by Institution bills/receipts

- Life Insurance Premium for life cover of student/co- borrower for total tenure of loan

- Any other expenses related to education

Interest Rate and Charges

| Loan Amount (in ₹) | Interest Rates |

| For loans up to ₹7.50 lakhs | 1 year RBLR + 1.70% |

| For loans above ₹7.50 lakhs | 1 year RBLR + 2.50% |

A refundable fee of ₹5,000 (excluding GST) is payable, which will be returned once the loan is disbursed, in addition to Vidyalakshmi portal charges of ₹100 plus 18% GST. A one-time fee will be applied for any deviation from education loan scheme norms, including approval of courses outside the scheme as below:

| Scheme Norms | Charges |

| Up to ₹4 lakhs | ₹500 |

| More ₹4 lakhs & up to ₹7.50 lakhs | ₹1,500 |

| More than ₹7.50 lakhs | ₹3,000 |

Star Vidya Loan

Under this education loan scheme, financial support will be provided for students pursuing studies in premier Indian institutions. It offers several advantages, including no processing charges, no collateral security requirement, zero margin, and no documentation, hidden, or prepayment charges. Education loan takeover from other banks will also be facilitated. The student loan amount varies depending on the institution, with ₹40.00 Lacs available for List “A” institutes, ₹25.00 Lacs for List “B” institutes, and ₹15.00 Lacs for List “C” institutes.

Eligibility Criteria

- Applicants must be Indian nationals.

- Applicants must have gained admission to select premier educational institutions in India through an entrance test or selection process.

- Eligible courses include regular full-time degree/diploma programs (certificates and part-time courses are excluded) and full-time executive management courses like PGPX (for IIMs).

- This education loan requires no margin or collateral; however, parent(s)/guardian(s) must act as co-borrowers, and future income will be assigned.

Interest Rates and Charges

| List of Institutes | Interest Rates |

| List A | RBLR+CRP 0.00% Less BSD 0.85%; presently 8.25% per annum |

| List B | RBLR+CRP 0.00% Less BSD 0.35%; presently 8.75% per annum |

| List C | @RBLR; Presently 9.10% per annum |

| List D | RBLR+CRP 0.50%; presently 9.60% per annum |

| No other concessions will be applicable. | |

Repayment: A moratorium period of up to one year after the course period is granted, followed by a 15-year repayment period from the date repayment begins.

Charges: There are no processing charges on the Bank of India Star Vidya Loan.

Credit Coverage: Education loans up to ₹7.50 lacs, conforming to the IBA Model Education Loan Scheme guidelines for studies in India and abroad, are eligible for coverage under CGFSEL by the National Credit Guarantee Trustee Company (NCGTC).

Star Progressive Education Loan

This education loan program provides financial support to students studying from pre-school through senior secondary school in India. This education loan scheme includes no processing, documentation, hidden, or prepayment charges, as well as no collateral or margin requirements for loans up to ₹4 lakhs. For student loans up to ₹4 lakhs per educational stage are available. Star Progressive Education Loan is repayable in 12 equated monthly installments beginning immediately after disbursement.

Eligibility Criteria

- Both the parent(s) and the student must be resident Indian nationals.

- An education loan will be given to the parent (father or mother) who has a reasonable source of income.

- Applicants must have secured admission to a recognised school/high school/junior college in India, including CBSE, ICSE, IGCSE, and State Boards for one of the following educational stages:

- Stage I: Pre-school (Play school to Class 2)

- Stage II: Primary School (Class 3 to 5)

- Stage III: Upper Primary School (Class 6 to 8)

- Stage IV: Secondary School (Class 9 & 10)

- Stage V: Senior Secondary School (Class 11 & 12)

Loan Amount and Margin: Student loans amounting to up to ₹4 lakhs are available per stage, with zero margin requirement.

Interest Rates and Charges

The interest rate for this loan is RBLR + 1.70% per annum, calculated monthly and subject to change. Repayment period for Star Progressive Education Loan is required in 12 equal monthly installments (EMIs) beginning immediately after student loan disbursement. While there are no processing charges, a portal fee of ₹100 plus 18% GST will be applicable. A one-time charge will be levied for any deviations from the scheme norms, including approval of courses outside the scheme, and ranges from ₹500 to ₹3,000 depending on the student loan amount. Furthermore, applicants will be responsible for fees charged by third-party service providers who operate the common student loan application portal.

Also Read: ICICI Education Loan – Eligibility, Benefits and Documents Required

Star Pradhanmantri Kaushal Rin Yojana

This skill development loan program offers zero processing, documentation, hidden, or prepayment fees. For education loans up to ₹7.5 lakhs require no collateral, and there’s zero margin requirement for student loans up to ₹4 lakhs.

Loan amounts ranging from ₹5,000 to ₹7.5 lakhs will be provided based on need and earning potential of the borrower. Student loans under this scheme will be covered by Credit Guarantee Fund Scheme for Education Loans (CGFSEL). Optional term insurance is available for the borrowers.

Eligibility Criteria

- Only Indian nationals are eligible to apply for this scheme.

- Students must have secured admission to a course run by one of the following:

- Schools recognised by Central or State education boards

- Industrial Training Institutes (ITIs)

- Polytechnics

- Colleges affiliated with recognized universities

- Training partners affiliated with the National Skill Development Corporation (NSDC), Sector Skill Councils, State Skill Missions, or State Skill Corporations, as per the National Skill Qualification Framework (NSQF)

- Under this scheme, courses aligned with the National Skills Qualifications Framework (NSQF) and preferably leading to a certification, diploma, or degree issued by the above-mentioned training institutes are covered.

Other Criteria:

- There is no minimum course duration.

- There is no minimum age limit. However, if the student is a minor, the parent(s) will execute the loan documentation, and the bank will obtain a letter of acceptance/ratification from the student upon reaching majority.

- The minimum qualification requirement will be as defined by the enrolling institutions/organisations per the NSQF.

Expenses Covered

Under the Star Pradhanmantri Kaushal Rin Yojana, following expenses will be covered:

- Tuition/Course fee

- Caution deposit

- Examination/Library/Laboratory fee

- Purchase of books, equipments and instruments

- Any other reasonable expenditure found necessary for completion of the course

Interest Rates and Charges

Interest will be charged at RBLR with an additional 1.50 credit risk premium.

Repayment Period

The moratorium period for this loan will be up to the duration of the course plus one year. The student loan will be repaid after the moratorium period as follows:

| Loan Amount | Repayment Period |

| Loan Up to ₹50,000 | – |

| Loans between ₹50,000 to ₹1 lakh | Up to 5 years |

| Loans above ₹ 1 lakh | Up to 7 years |

A portal fee of ₹100 plus 18% GST will be applicable under this scheme. One-time charges will be levied for any deviations from the scheme norms, including approval of courses outside this loan scheme, and range from ₹500 for education loans up to ₹4 lakhs, to ₹1,500 for education loans more than ₹4 lakhs and up to ₹7.50 lakhs. For education loans over ₹7.50 lakhs, the applicable fee amount is ₹3,000. Students may also be required to pay fees charged by third-party service providers operating the common loan application portal.

Also Read: Dos and Don’ts to Avoid Educational Loan Application Rejection

Star Education Loan – Working Professionals

Eligibility Criteria

- Applicants must be Indian nationals and below 55 years of age.

- Applicants should be permanent employees of Central/State Government, reputed Private Sector/MNC/Public Sector companies or institutions.

- Applicants must be gainfully employed during the entire course period with work experience of at least 2 years.

- Applicants should have no adverse credit history.

Eligible Courses:

- This student loan is available for part-time or distance education courses offered by recognised universities.

- Online/Offline Executive Diploma/Certificate Programs (EDPs) provided by top-notch B-schools listed in “List – A” under the Star Vidya Loan scheme are also eligible.

- Margin:

- A 5% margin is required for loans up to ₹4 lakhs.

- A 10% margin is required for loans above ₹4 lakhs and up to ₹7.50 lakhs.

- A 15% margin is required for loans above ₹7.50 lakhs.

- Security:

- No collateral security is required for loans up to ₹4 lakhs.

- For student loans above ₹4 lakhs, tangible collateral security of suitable value acceptable to the bank is required, along with an assignment of the student’s future income for installment payments.

Interest Rate and Charges

| Loan Amount (in ₹) | Interest Rates |

| For loans up to ₹7.50 lakhs | 1 year RBLR + 1.70% |

| For loans above ₹7.50 lakhs | 1 year RBLR + 2.50% |

A refundable fee of ₹5,000 (excluding GST) is payable, which will be returned once the loan is disbursed, in addition to Vidyalakshmi portal charges of ₹100 plus 18% GST. A one-time fee will be applied for any deviation from education loan scheme norms, including approval of courses outside the scheme as below:

| Scheme Norms | Charges |

| Up to ₹4 lakhs | ₹500 |

| More ₹4 lakhs & up to ₹7.50 lakhs | ₹1,500 |

| More than ₹7.50 lakhs | ₹3,000 |

Repayment Period

The repayment period for this education loan scheme has no post-course completion moratorium. Repayment of the loan must be completed by the applicant’s 60th birthday or within 10 years of course completion, whichever occurs earlier.

Repo Based Lending Rate (RBLR) – Bank of India

The Repo Based Lending Rate (RBLR) was 9.35% for most of 2024, based on a repo rate of 6.50% and a markup of 2.85%, but was slightly lower at 9.25% for the first three months of the year, based on a repo rate of 6.50% and a markup of 2.75%.

Also Read: Education Loan Interest Rate – A Detailed Analysis for Popular Banks

Documents Required Bank of India Education Loan

Students are required to submit the following required documents to apply for an education loan under Bank of India:

| Documents Required from the Applicant | Documents Required from the Co-applicant |

| Proof of Identity such as PAN & Aadhaar card | Proof of Identity such as PAN & Aadhaar card |

| Proof of Address such as electricity bill, Aadhaar card, Driving license, etc. | Proof of Address such as electricity bill, Aadhaar card, Driving license, etc. |

| Academic records such as Class 10, 12, & Graduation certificates & marksheets (if applicable) | Income Proof such as ITR/Form 16/Salary Slip etc. |

| Admission proof/Qualifying examination result (if applicable) | Two passport-sized photographs |

| Schedule of study expenses | One year bank statement |

| Two passport-sized photographs | Collateral security details & documents (if applicable) |

| Vidyalakshmi portal reference number | |

| Vidyalakshmi portal application number |

Bank of India Education Loan Application Process

Step 1: Visit the official website Bank of India (bankofindia.co.in/)

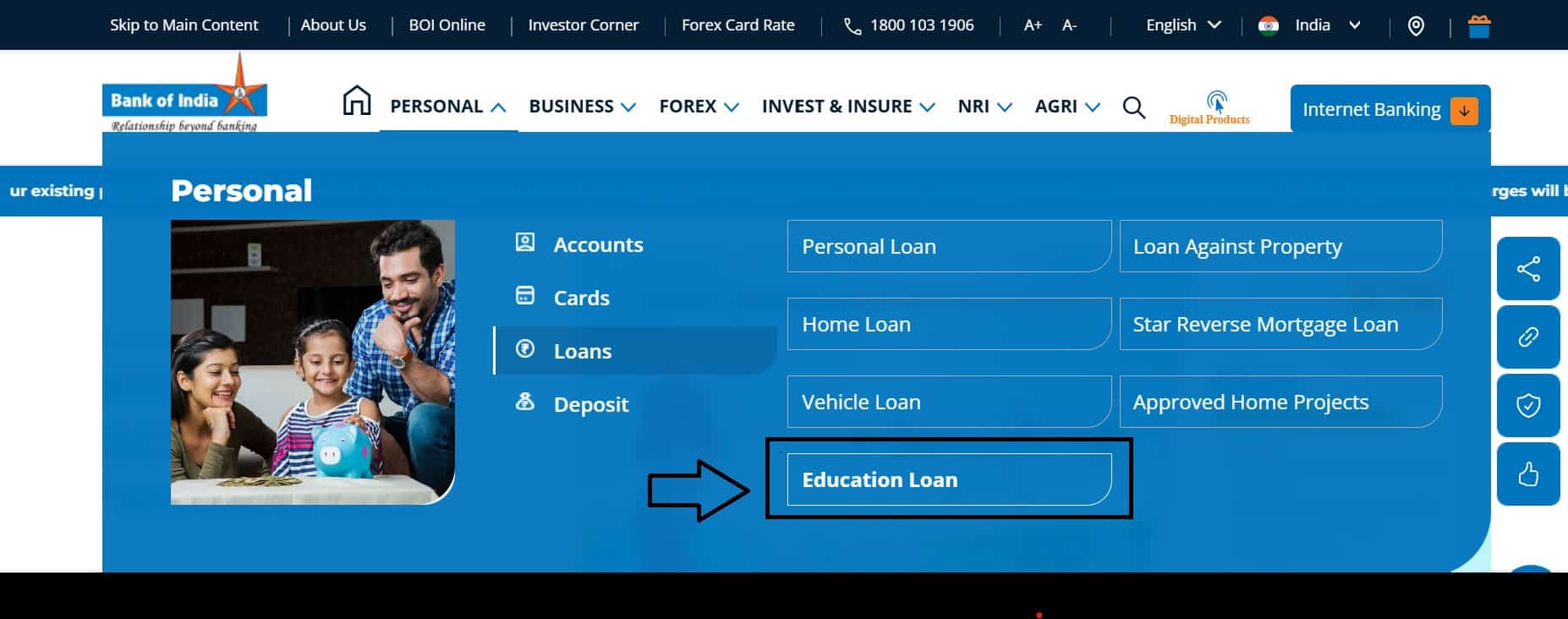

Step 2: Navigate to the ‘Personal’ option in the menu. A drop-down menu will appear; click on ‘Loans,’ and then select ‘Education Loan’ from the loan list.

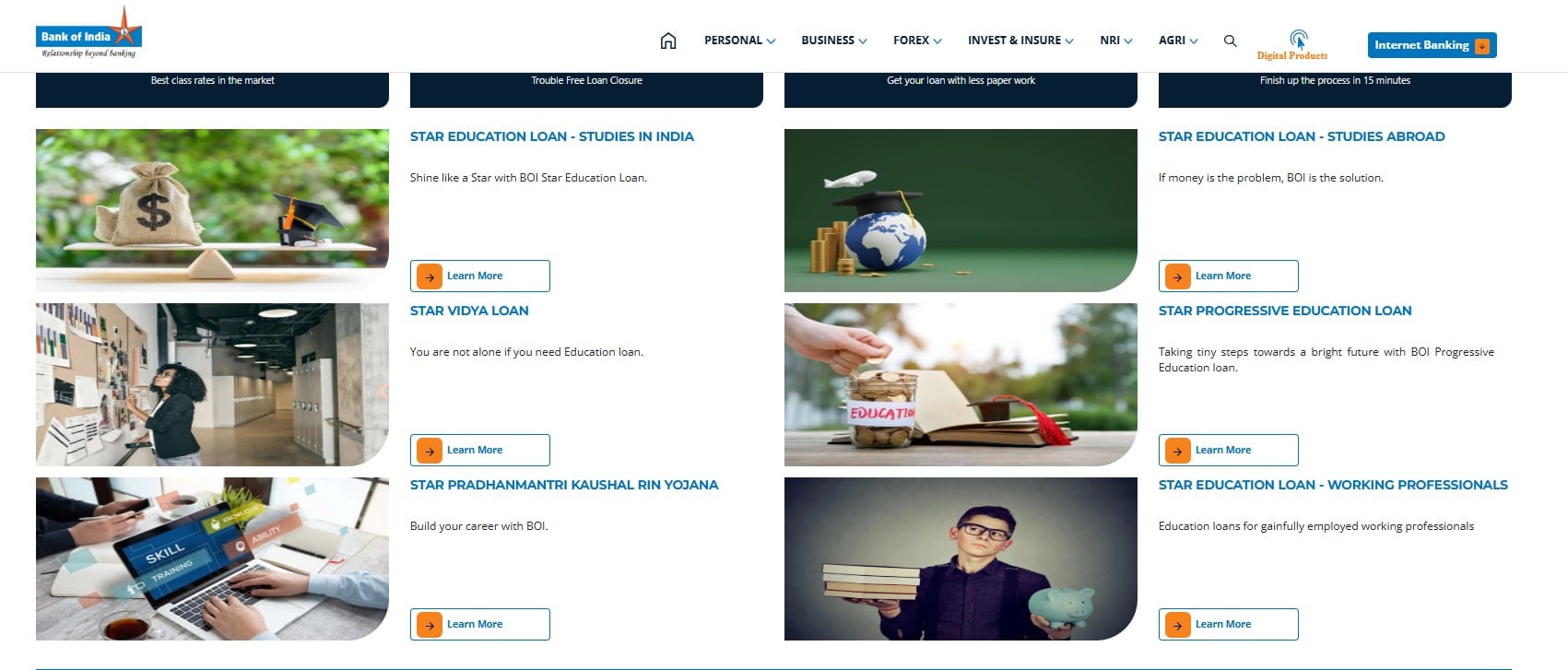

Step 3: Click on the ‘Learn More’ button to access the details of the particular loan scheme.

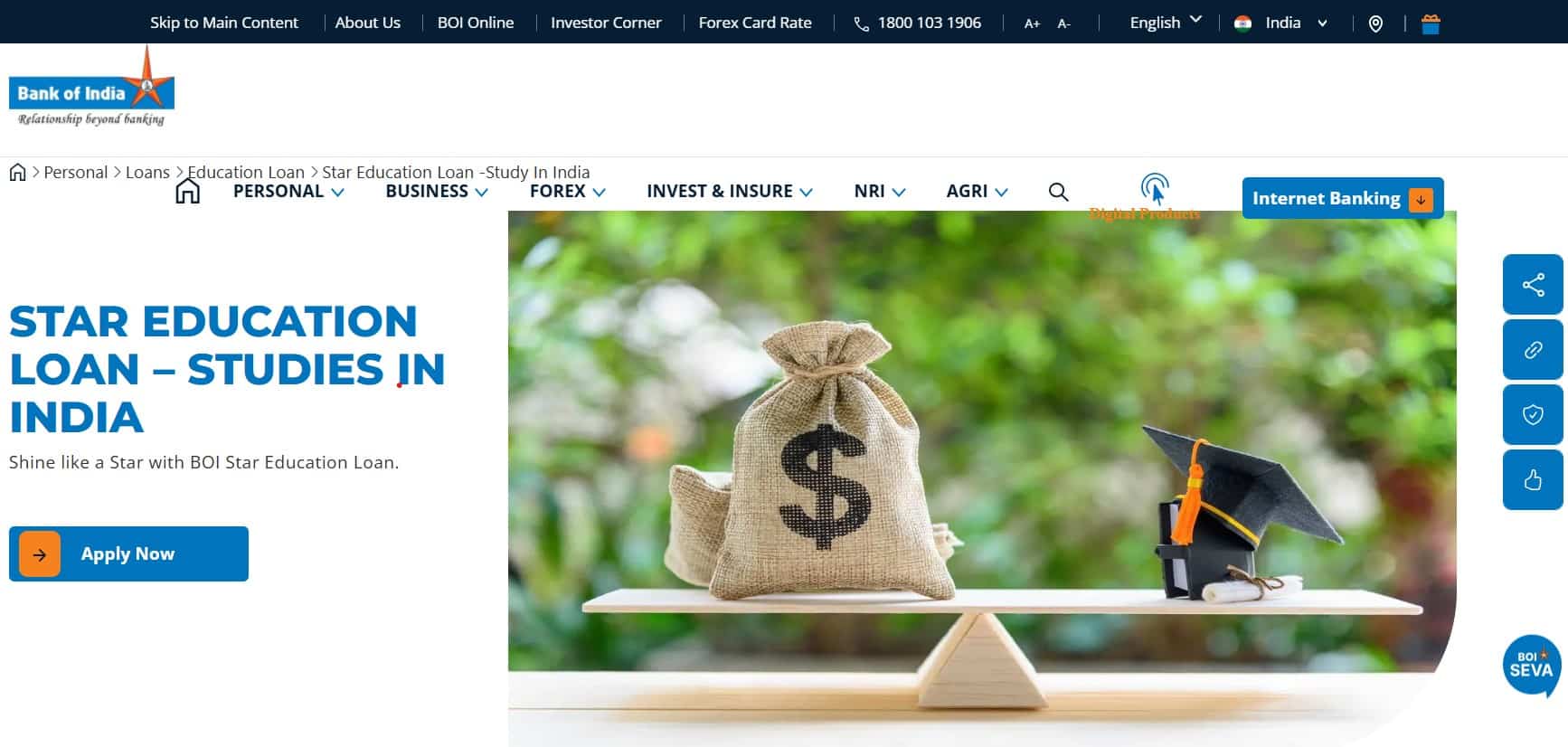

Step 4: For each education loan scheme, you will see an ‘Apply Now’ button at the left-hand side of the dashboard. Click on it to access the application form at Vidyalakshmi Portal.

Step 5: Now, navigate to the registration page. Fill in the details, register yourself and complete the application form for the respective loan scheme.

To know about the complete education loan application process at Vidyalakshmi Portal, Read Vidyalakshmi Portal – Government Education Loan Services

Frequently Asked Questions (FAQs)

What are the eligibility criteria for the various Star Education Loan schemes?

Eligibility criteria for the loan schemes offered by the Bank of India varies. For studies in India, applicants must be Indian Nationals, PIOs, or OCIs who have secured admission to a recognised institution approved by UGC, AICTE, or the Government)via an entrance test or merit-based process. For studies abroad, only Indian Nationals are eligible, and admission must be secured at a recognised institution.

What expenses are covered by these education loan schemes?

Education loan programs covers a comprehensive range of education-related expenses.Generally, these include tuition fees, fees payable to the institution, examination and library fees, purchase of books, equipment, or laptops, travel expenses (for studies abroad), life insurance premiums for the student/co-borrower, and even caution or refundable deposits.

What are the interest rates and additional charges for these loans?

Bank of India Education Loan Interest rates are calculated based on the one-year Repo Based Lending Rate (RBLR) plus 1.70% for loans up to ₹7.50 lakhs, and RBLR plus 2.50% for loans above ₹7.50 lakhs. For detailed information refer to the article above.

What documents are required when applying for a Bank of India Education Loan?

Applicants and co-applicants are required to provide the below documents:

- Proof of identity (e.g., PAN card, Aadhaar card)

- Proof of address (e.g., electricity bill, driving license)

- Academic records (Class 10, 12, graduation certificates/marksheets, if applicable)

- Income proof (such as ITR, Form 16, or salary slips)

- Admission proof or qualifying examination results

- Two passport-sized photographs (for both applicant and co-applicant)

- A one-year bank statement

- Collateral security documents (if applicable)

- Vidyalakshmi portal reference and application numbers

What are the repayment terms and moratorium periods for these loans?

Repayment terms differ among various student loan schemes. Refer to the above article for the detailed information on the repayment terms and moratorium period of Bank of India education loan.