Axis Bank Education Loan: For a lot of students pursuing higher education is more than a milestone; it’s a gateway to endless opportunities. Yet, the costs of tuition, accommodation, and other expenses often create roadblocks for aspirational students and leave them and their families struggling with financial stress. And education loans offered by banks such as Axis Bank serves as a substantial support for them that enables them to pursue their academics without compromising on quality or ambition.

Take the story of Radha, for instance. A bright student from a modest background, she had secured admission to a popular university abroad. However, the happiness of receiving an offer letter from her dream university was overshadowed by the financial burden it entailed. That’s when the Axis Bank education loan emerged as a saviour to her. It not only helped her to cover her tuition fees and other related expenses of the course, but also helped her to focus on her academics stress-free.

With certain amazing features like zero processing fees, competitive interest rates, and no margin money requirements for certain loan limits, Radha’s journey from aspiration to achievement became smoother. Today, she is pursuing her dream course in a university abroad and all the credit goes to the Axis Bank for helping her to turn her dreams into reality.

Axis Bank’s education loans are more than financial support; they’re a step towards students empowerment who are inspired to do best in their lives. Below are the features that are being offered by the Axis bank education loan to make a student’s academic dreams attainable:

| Feature | Description |

| Loan Amount | Minimum: ₹50,000 |

| Loan Coverage | Tuition fees, hostel charges, books, etc. |

| Interest Rates | Repo Rate Linked |

| Pre-Admission Sanction | Available based on profile |

| Margin |

|

| Courses | Career-oriented courses such as Medicine, Engineering, Management, etc. at Graduate & Postgraduate level |

| Disbursal | Within 15 working days |

| Co-Applicant | Parent(s) or Guardian (Primary Debtor) |

| Loan Security | Third-party guarantee, Collateral (LIC policy, tangible assets), Assignment of future income |

| Disbursement Method | Direct to Institution |

Axis Bank Education Loan – Eligibility Criteria

Axis Bank simplifies student loan selection by offering two clear categories:

- Education loans for studies in Indian institutions

- Education loans specifically designed for foreign education

This streamlined approach ensures that applicants can easily find the right fit in alignment to their academic aspirations. To ensure a smooth application process, Axis Bank considers the financial and academic background in the process of determining eligibility of the applicants for an education loan.

Both existing customers of the Axis Bank and the new applicants can apply easily, as long as they meet the below-mentioned eligibility criteria:

- Applicants must be a citizen of India.

- They must have secured a minimum of 50% marks in Higher Secondary Certificate (HSC) i.e. (10 + 2) or an equivalent followed by graduation.

- Applicants must have been admitted to career-oriented courses such as engineering, medicine, management, etc. at either graduation or postgraduate level.

Axis Bank Education Loan – Advantages

Students seeking financial aid for education can choose between unsecured and secured loans. Let us consider the following features of an unsecured loans:

Unsecured loans do not require collateral per se and the quantum of loan varies as follows:

- The loan amount is up to ₹75,00,000.

- Students scoring well in the entrance exams can qualify for higher amounts of education loan up to ₹50,00,000.

- Working professionals can also benefit from unsecured loans up to ₹20,00,000 without needing the requirement of a co-applicant.

Secured loans, on the other hand, are suitable for larger amounts exceeding ₹75,00,000 or for those seeking potentially lower interest rates.

- Secured loans require collateral and have no upper limit on the amount that can be borrowed.

- An additional benefit for both unsecured and secured loans is the pre-visa disbursement option. This allows students to receive a portion of the loan amount before their visa is issued, helping to manage initial expenses abroad.

Other benefits include the following:

- Complete Financing: Axis Bank provides education loans starting from ₹50,000 with no upper limit, covering up to 100% of the total education cost, both in India and abroad. This ensures students have the resources they need to focus on their studies.

- Coverage of Living Expenditures: Considering the fact that students have to spend money as living expenses beyond tuition, Axis Bank’s loans cover costs incurred on accommodation, food, and travel, ensuring students are financially supported throughout their academic journey.

- Faster Loan Disbursal: Once approved, Axis Bank expedites the loan process, disbursing funds within two days. They also allow for customisation of education loans to address any unforeseen educational expenses.

- Pre-admission Sanction: To ease the application process for universities and visas, Axis Bank offers provisional loan sanction letters even before a student secures admission. This demonstrates financial readiness and commitment to streamline the application journey.

Also Read: HDFC Education Loan Interest Rate – Eligibility, ROI & Features

Axis Bank Education Loan – Interest Rates & Charges

One of the most basic concerns of the applicants relates to the cost of financing their academic journey. Axis Bank recognises this concern and offers competitive education loan interest rates, covering up to 100% of cost incurred on educational expenditures in India and abroad.

The bank prioritises a smooth loan disbursal experience combined with the features like faster disbursement after ensuring a hassle-free application process. Beyond competitive rates, Axis Bank provides personalised guidance and convenient repayment options to make student loan management easier.

In essence, Axis Bank aims to provide a comprehensive student loan solution that addresses both financial needs and the overall loan experience. Let us know about the details further.

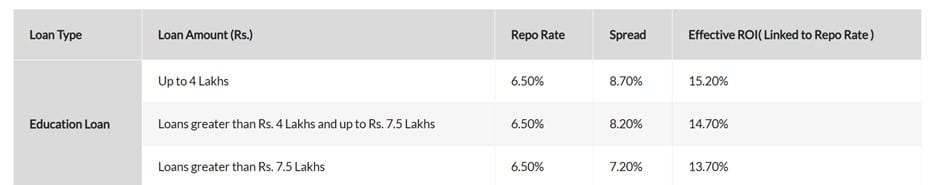

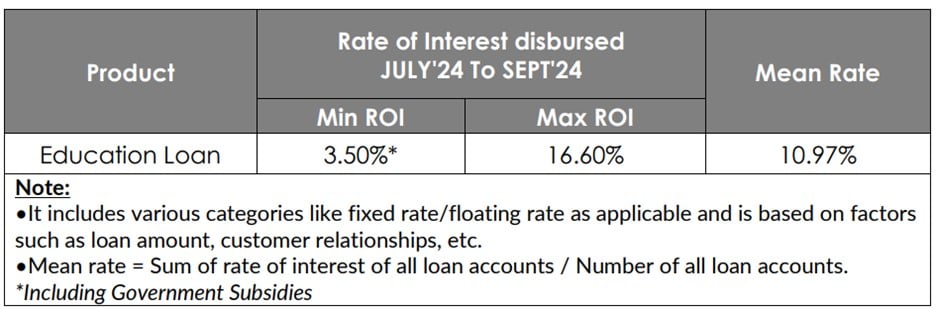

| Important Note:- For education loans approved on or after October 1, 2019, the interest rate is linked to the Repo Rate, which is currently 6.50%. The bank may add a margin to this Repo Rate to determine the final interest rate you pay. This margin can fluctuate over the life of the loan repayment period.

Applicants who have obtained education loans or received the approval before October 1, 2019, will continue under the Marginal Cost of Funds Based Lending Rate (MCLR) system. However, existing borrowers can contact the bank and their customer service to discuss available options on switching to the Repo Rate system. |

For Education Loans Based on the Marginal Cost of Funds Based Lending Rate (MCLR):

The current MCLR for Education Loans is 9.30% with a reset interval of every six months.

Name of the Scheme: Study Power

Loan Processing Charges: Applicable as per the details given below

Prepayment Charges: NIL

No Due Certificate: N/A

Penal Charge:

- Financial Default*: 8% per annum as per the applicable interest rate on the overdue amount (subject to the aggregate not exceeding 24% per instance).

- There shall be no capitalisation of penal charges.

- Aforesaid mentioned penal charges will be subject to GST as per the law applicable on Goods and Service Tax in India, and GST will be charged separately.

*Financial default includes all types of payment or financial defaults/irregularities with respect to your loan account.

- Cheque/Instrument Swap Charges: ₹500 + GST per instance

- Duplicate Statement Issuance Charges: ₹250 + GST per instance

- Duplicate Amortization Schedule Issuance Charges: ₹250 + GST per instance

- Duplicate Interest Certificate (Provisional/Actual) Issuance Charges: ₹50 + GST per instance

- Cheque/Instrument Return Charges: ₹339 + GST per instance

- Conversion Charges for Switching from Floating to Fixed Rate and Vice-versa: 1% of the outstanding principal with a minimum of ₹5,000 + Applicable GST

Rate of Interest Applicable on Education Loan from August 1st, 2022

Note:- Education loans are repaid through fixed monthly payments called Equated Monthly Installments (EMIs). These EMIs cover both the principal amount the applicant has borrowed and the interest accrued.

Axis Bank Education Loan – Required Documentation

Applicants for Axis Bank Education Loans should submit their required documents for an education loan following the process as streamlined. To initiate your application, you’ll primarily need identification and academic documents, along with some initial financial assurances. This simplifies the initial stages and allows the bank to assess your eligibility efficiently. In later stages, the bank may require additional documentation depending on the specifics mentioned in the loan request. The complete details of documents required for the Axis Bank student loan are listed below:

Documents Required for Education Loan for Salaried Individuals:

- KYC documents

- Bank Statement/Passbook details of last 6 months

- Copy of admission letter from the institute along with fee schedule

- Marksheets/passing certificates of S.S.C., H.S.C. degree courses

Documents Required for Education Loan for All Other Individuals:

- KYC documents

- Bank Statement/Passbook details for the last 6 months

- Guarantor form (optional)

- Copy of admission letter from the institute along with fee schedule

- Marksheets/passing certificates of S.S.C., H.S.C. degree courses

Documents Required for Subsequent Disbursement:

- Demand letter from college or university

- Disbursement request form signed by applicant, co-applicants

- Receipts of margin money paid to the college/university along with bank statement reflecting the transaction

- Exam progress report, marksheet, bonafide certificate (any one)

- Form A2 signed by applicant or co-applicants as required in the case of institutes located overseas

Also Read: Canara Bank Education Loan – Benefits, Interest Rates and Scheme Details

Axis Bank Education Loan: How to Apply?

Students fulfilling the eligibility criteria for education loan through Axis bank can easily and conveniently apply for an Axis bank education loan. The typical processing time for an education loan application is 15 days. However, this timeframe may vary depending on the loan amount and the requirements involved. The students can apply for the Axia bank education loan both online and offline.

Online Application via Axis Bank Education Loan Portal:

Students can conveniently apply for an education loan on the online portal of Axis Bank through a dedicated webpage. The process is simple as mentioned in the steps outlined below:

Step 1: Visit the official website of the Axis Bank (www.axisbank.com)

Step 2: Navigate to the ‘Login’ button in the right-hand side of the dashboard and register yourself by entering required details.

Step 3: After successful registration, fill in the details in the education loan application form, enter the captcha code given, tick the checkbox and click the ‘Submit’ button’.

Note:- After successful registration, the Axis bank will connect with the scholar. The education loan approval may take 7-10 working days. Upon approval of your loan, you can expect to receive the funds within two working days.

Offline Application for Axis Bank Education Loan:

Students can choose to apply offline for the education loan by visiting their nearest branch or office. Applicants might need to complete documentation requirements as mentioned above in place before they apply offline to avoid multiple visits to the bank. The steps to apply for an Axis Bank student loan offline are as follows:

Step 1: Download the Application Form for Study Power by Axis Bank. This is the name of the Axis Bank Education Loan scheme.

Step 2: Fill in the correct details of the applicant along with the co-applicant.

Step 3: Provide personal, academic and the financial details; a PAN Card/Aadhaar Card is mandatory.

Step 4: Submit the form along with the photographs and other supporting documents.

Finally, submit your application in person to the nearest branch along with the documents. Applicants can choose the one that is most convenient for them and apply for the Axis Bank Education Loan. The Axis Bank has a uniform turn-around time for all the application types and is equally considerate in taking all applications into account.

Axis Bank’s Education Loan Subsidy Schemes

Axis Bank provides education loans to students under various government subsidy schemes, including the Central Sector Interest Subsidy Scheme and the West Bengal Student Credit Card Subsidy Scheme.

Axis Bank provides education loans to students under various government subsidy schemes, including the Central Sector Interest Subsidy Scheme and the West Bengal Student Credit Card Subsidy Scheme.

Central Sector Interest Subsidy Scheme

This government subsidy scheme is designed for students belonging to the economically weaker sections (EWS), where the annual parental income of the student from all sources must not be more than ₹4.5 lakhs. It is applicable to education loans taken under the IBA-approved Model Educational Loan Scheme for students who are pursuing approved technical and professional courses at recognised institutions within India. Under this scheme, students can avail a loan of up to ₹7.5 lakhs without any collateral security or a third-party guarantee, subject to fulfilling the scheme’s conditions.

Students applying for this scheme must submit specific documents at the time of loan sanction. The necessary documents include an income certificate issued by the designated authority of the respective state government and a bonafide certificate of the applicant. If the student is eligible for the subsidy, they will be required to sign an Interest Subsidy Agreement and a Letter of Undertaking cum Declaration to complete the loan process.

West Bengal Student Credit Card Subsidy Scheme

This scheme is available exclusively for students who are bonafide residents of West Bengal and pursuing higher education in India or abroad. Under this scheme, students can apply for loans of up to ₹10 lakhs without any collateral security, adhering to the norms of the scheme.

Axis Education Loan Programme EMI Calculator

The Axis Bank Education Loan Programme EMI Calculator is very simple to use. Students can simply calculate their Equated Monthly Installments (EMIs) for their Axis bank student loan through this education loan EMI calculator. This online tool enables users to determine their monthly repayment obligations by entering the loan tenure, interest rate, and loan amount.

FAQs on Axis Bank Education Loan Programme

What is an education loan?

An education loan is a type of financial aid specifically designed to help needy students to cover their costs incurred on higher education. This can include tuition fees, books and laptop, living expenses, and other related expenditures. Education loans are offered by the banks and other financial institutions along with repayment terms that usually begin after the completion of studies or a moratorium period following after.

Can I switch over to a fixed rate loan or vice versa and if yes then how many times?

Yes, switching over to a fixed rate loan or vice versa can be exercised 3 times during the tenure of your loan as per the bank’s approved policy. This has been made effective from 01 Jan 2024.

What is the current effective ROI for Education Loans up to Rs. 4 Lakhs?

The current effective ROI for education loans up to ₹4 lakh is 15.20%.

How is the interest rate for Education Loans calculated?

The interest rate is calculated by adding the current Repo Rate (6.50%) to the applicable spread.

What is the maximum amount a student can avail via the Axis Bank Education Loan programme in India?

The Axis Bank caters to diverse education financing needs by offering both secured and unsecured loan options. Unsecured loans range from ₹20 lakh for working professionals to ₹75 lakh for students with an excellent academic record, potentially determined by marks scored in the entrance exam. Secured loans, on the other hand, have no upper limit on the amount but are tied to the value of the collateral you provide. To further ease the burden for students willing to pursue their studies abroad, Axis Bank offers a pre-visa disbursement facility while ensuring timely access to funds.

Who is eligible to claim a deduction under Section 80E of the Income Tax Act?

Individuals can claim deductions for the interest paid on education loans. This benefit does not extend to Hindu Undivided Families (HUFs) or other non-individual taxpayers.

The loan must be used to finance higher education for the taxpayer themself, their spouse, their children, or a legal ward.

Why should I take an education loan?

An education loan can bridge the financial gap and empower you to pursue your educational aspirations. It eliminates financial constraints as a barrier, ensuring you don’t miss out on valuable learning opportunities. Education loans can cover 100% of your expenses, including tuition, living costs, and even travel. Additionally, they often come with competitive interest rates, tax benefits, and a flexible repayment grace period.

When can I start repaying my education loan?

Education loans usually come with a moratorium period. This grace period typically lasts for the duration of your course, plus an additional 6 months (extendable to 12 months in some cases). It allows you to focus on your studies without facing immediate financial pressure. However, interest on the disbursed amount accrues at a simple rate during this time. Your EMI payments will begin once the moratorium period ends.

What should I consider taking into account before applying for an education loan?

The applicants must keep in mind the following factors before applying for an education loan:

- Budgeting: Plan a budget including tuition, living expenses, travel, etc. Apply for the loan amount that covers everything.

- Quantum of Loan and Repayment Period: Higher the amount and the duration of the repayment period, higher is the accrued interest burden and vice versa, and therefore applicants should plan accordingly and carefully.

- Apply Early: Get your application in well before the deadline to allow for processing and potentially secure limited funds.

- Scholarships & Grants: Explore these options to reduce your loan burden!

- Future Job Prospects: Consider job opportunities after your studies, especially for expensive programs.

- Tax Benefit: Section 80E allows tax deductions for education loans.

What shouldn’t I do at the time of applying for an education loan?

Applicants must not do the following things at the time of applying for an education loan:

- Ignoring Repayment Terms: Don’t overlook the loan’s repayment details. Understand your capacity and obligations to repay on time.

- Rushing the Application: Take your time. Read the terms and conditions carefully, and ensure all information in your application is accurate.

- Poor Communication: Don’t hesitate to contact your lender if you face difficulties repaying your loan. Many lenders offer flexible options for borrowers facing financial challenges.

Unnecessary Multiple Loans: Avoid taking out multiple loans unless absolutely necessary. Managing repayments for multiple loans can be overwhelming. Try to manage your expenses as much as possible.

2 thoughts on “Axis Bank Education Loan – Amount, Interest Rates & Features”