Crowdfunding your education refers to the idea of raising small amounts of money from a large number of people. This is being done typically via online platforms and utilised in covering the costs of tuition, books, accommodation, or other academic expenses. This alternative financing method is so popular among students who may not qualify for traditional education loans, scholarships, or grants.

Unlike student loans that require repayment, collateral or scholarships that involve eligibility criteria and certain terms and conditions, crowdfunding is often a more accessible and flexible option. Students can use various online platforms like Ketto, Milaap, ImpactGuru, GoFundMe, Kickstarter, or Fueladream to share their story, explain their academic goals, and request financial support from friends, family, alumni networks, and even strangers who resonate with their journey.

The key to a successful crowdfunding campaign lies in authenticity and storytelling. Potential donors are more likely to contribute if they understand your background, challenges, aspirations, and how their contribution will make a real difference. Adding photos, videos, academic achievements, and regular updates builds trust and keeps supporters engaged.

Crowdfunding also allows students to leverage their community and social networks. It encourages people to come together for a cause, whether it’s helping someone to attend a top university abroad or supporting first-generation learners in rural areas. Many students also reach out to media, influencers, or NGOs to help amplify their campaigns and get support to finance their aspirations.

Pros and Cons of Crowdfunding in India

Below table enlists the pros and cons of crowdfunding in India:

| Pros | Cons |

| Funds are raised through gifts/donations, not loans. Hence, no repayment needed. | Success is not guaranteed as many campaigns fail to meet their goals. |

| Fast & Flexible – Campaigns can be launched quickly and easily. | Requires ongoing marketing and social media promotion. |

| Compelling stories using emotional appeal effectively attract donors. | Sharing personal and financial details publicly raises privacy concerns. |

| Helps in building a support network by encouraging community and mentorship. | A cut of the funds goes to the platform and payment processing. |

| Raises awareness through highlighting issues related to education access. | Friends/family may not be able to contribute repeatedly which leads to donor fatigue. |

| Teaches financial planning by encouraging budgeting and accountability. | Without marketing, the campaign might stay local which limits the reach of the campaign. |

Crowdfunding Platforms in India

| Crowdfunding Platforms for Students in India (Undergraduate or Postgraduate Degree) | ||||

| Platform | Best For | Why Choose It | Fees | Payout Time |

| Ketto | Indian students studying in India |

|

5–8% (platform + gateway fees) | 5–7 business days |

| Milaap | Low-income students, rural areas, NGOs |

|

Only payment gateway fees | Within 7 days |

| ImpactGuru | Students from Tier 2/3 cities |

|

5–8% | 7–10 working days |

| Crowdfunding Platforms for Students Planning to Study Abroad | ||||

| Platform | Best For | Why Choose It | Fees | Payout Time |

| GoFundMe | Indian students going abroad (USA, UK, etc.) | Global reach, trusted by international donors | 0% platform fee + 2.9% processing fee | 2–5 business days |

| ImpactGuru | Indian students going abroad | Accepts foreign donations, NRI-friendly | 5–8% in total | 7–10 working days |

| Fundly | International students with a U.S. focus | Easy setup, global payment support | 4.9% + 2.9% payment fees | 2–5 business days |

Is Crowdfunding Viable in India?

Crowdfunding has emerged as one of the promising ways to raise funds by gathering humble contributions from people across the globe. The funds are generated majorly through online platforms. While the concept is widely popular in countries like the United States and the United Kingdom, its viability in India is gaining traction by the time, especially among students, entrepreneurs, and individuals seeking funds for education, medical emergencies, or social causes.

But the question remains: is crowdfunding truly viable in the Indian context?

The answer lies in understanding the growing awareness, the challenges, and the evolving ecosystem around it.

a) Growing Popularity and Use Cases: India has witnessed a rise in crowdfunding platforms such as Milaap, ImpactGuru, FuelADream and more. Over the time, these platforms have successfully helped raise crores of rupees for education, medical emergencies, disaster relief, and creative projects. The rise of crowdfunding in both urban and semi-urban areas has been increasing through digital payment adoption, and active social media usage among people.

Students who are willing to finance their higher education and are unable to afford education loans and its terms, relying on crowdfunding to support their education dreams, especially when they are planning to pursue studies abroad.

b) Trust and Transparency: While the potential is strong, trust remains a key issue. Indian donors are often skeptical about their contributions and how it will be utilised. Offering transparency and credibility to them will lead to a successful campaign. Platforms that verify fundraisers, provide regular updates, and ensure fund usage transparency are more likely to gain traction among contributors.

Furthermore, donors often prefer contributing to causes or individuals they can relate to or are emotionally connected with. And social media reach is an important tool that helps to promote any crowdfunding campaign.

c) Regulatory and Awareness Challenges: India doesn’t have a clear regulatory framework which is specifically designed for crowdfunding. While these lending platforms operate within certain boundaries, the absence of strict guidelines sometimes creates grey areas, which could discourage both campaigners and donors due to lack of trust.

Another major challenge in the queue is awareness. Many potential fundraisers, especially in rural or low-income areas, are unaware of the concept of crowdfunding and how it works. Even among the educated, there is sometimes hesitation to seek public donations due to stigma or fear of judgment.

Also Read: Education Loan by Government of India

Real Life Success Stories

Below are some of the real life examples showcasing the viability of crowdfunding in India:

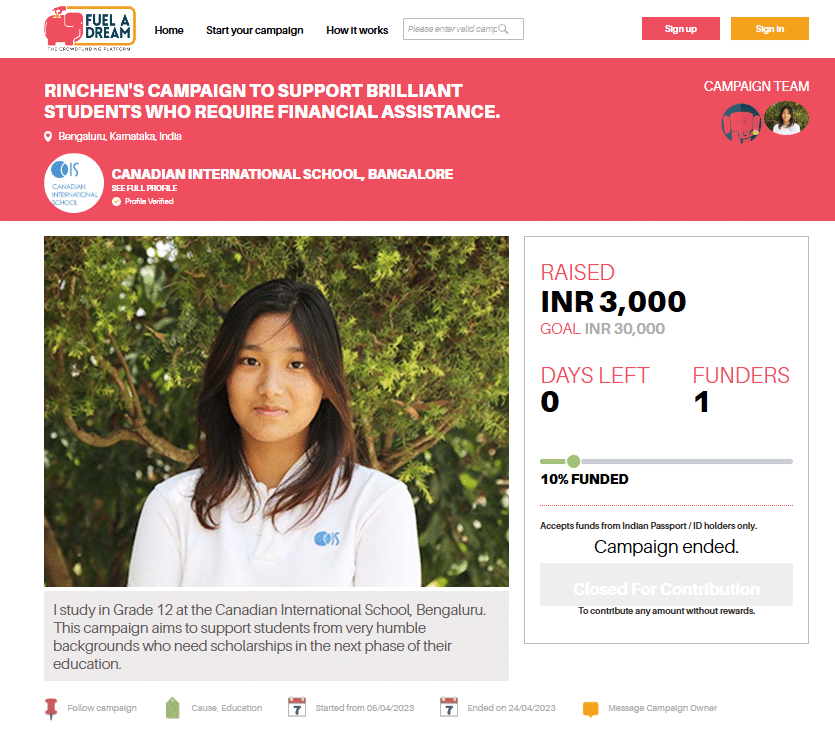

1. Rinchen’s Campaign to Support Brilliant Students

- Platform: Fueladream

- Purpose: To support students from modest backgrounds who are in need of scholarships to pursue higher education.

- Story: Rinchen, a Class 12 student initiated a crowdfunding campaign to assist academically promising students in need of financial support for university education.

- Result: ₹30,000 was successfully raised to support students in continuing their education.

- Umeed Academy’s Fundraiser for Underprivileged Children

- Platform: Milaap

- Purpose: To build a formal school building for underprivileged children in South 24 Parganas, West Bengal.

- Story: Wali Rahmani, founder of Umeed Academy, requested donations to construct a school building on 2 acres of land. His video appeal aimed to raise ₹10 crore by requesting ₹100 from 2 million individuals.

- Result: The highly effective appeal generated significant funds, reaching ₹6 crore within six days and ₹7 crore within one week, ultimately enabling the successful completion of the school building by March 2024.

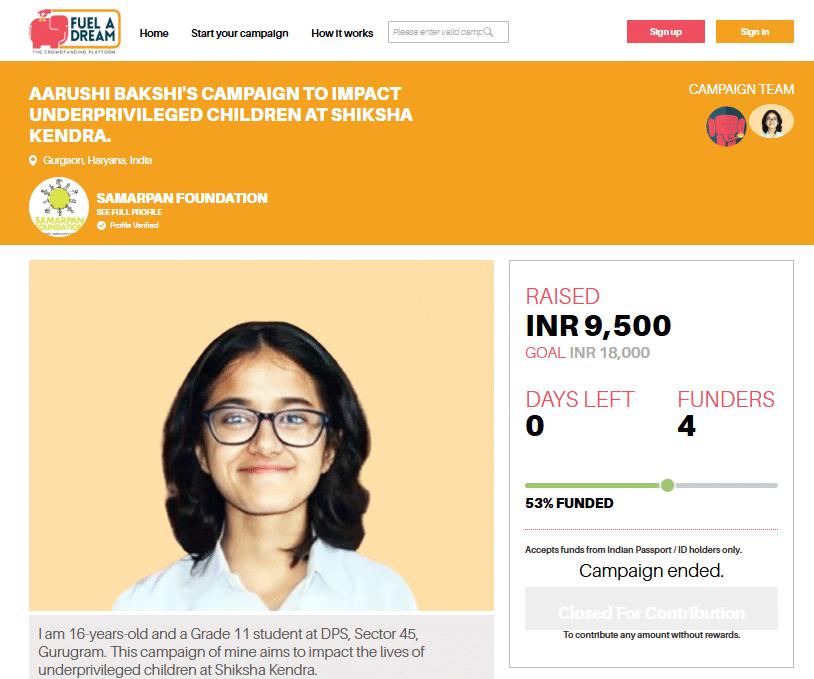

3. Aarushi Bakshi’s Campaign for Shiksha Kendra

- Platform: Fueladream

- Purpose: To provide traditional attire to underprivileged children at Shiksha Kendra.

- Story: Aarushi, a 16-year-old Class 11 student initiated this campaign to help children feel valued and confident during festivals and special occasions.

- Result: The campaign successfully raised ₹18,000 and enabled the provision of festive outfits for children who often feel excluded during festive occasions.

4. Asha’s Support for Delhi Slum Students Pursuing Higher Education Abroad

- Platform: Asha Society

- Purpose: To assist students from Delhi slums in pursuing higher education overseas.

- Story: Asha, an international charity, supported students like Chandan, Abhishek Handa, Tushar Joshi, and Amritesh Maurya to complete their education and pursue Master’s degrees at renowned institutions in foreign countries. These students achieved academic excellence with Asha’s support by overcoming challenges such as poverty and lack of resources.

- Result: The initiative enabled these students to study abroad and showcase the transformative power of education and community support.

Conclusion

Crowdfunding in India is becoming increasingly viable despite all the given challenges. The growing success stories, rise in digital literacy, and support from NGOs and educational institutions are helping to build a more robust ecosystem for it. With improved trust, storytelling support, and transparent implementation system from various crowdfunding platforms, more people are now aware and able to raise funds effectively.

Crowdfunding in India is still evolving. However, it is certainly becoming a viable and powerful tool to an extent, especially when traditional funding options fall short or seem unaffordable. It is poised to become a mainstream alternative for fundraising in the country as awareness, digital reach, and platform support continue to grow.

Also Read: Why Choose a Study Loan?

Frequently Asked Questions (FAQs)

What is Crowdfuding?

Crowdfunding is a process of raising funds by collecting small amounts of money from a large number of individuals. This amount is generally generated through online platforms. It helps individuals, startups, non-profit organizations, and businesses to raise capital for their projects or ventures by appealing to the collective interest of the public.

How does crowdfunding generally work?

Generally, a cause or project is presented on a crowdfunding platform with a funding goal. People contribute money, and if the goal is met, the funds are given to the fundraiser.

What are the different types of crowdfunding?

The most common types of crowdfunding include:

- Donation-based i.e. contributing without expecting a financial return, for example charity.

- Reward-based i.e. contributing in exchange for a product or service, for example any startups.

- Equity-based i.e. investing in exchange for ownership shares in a company.

- Debt-based (Peer-to-Peer Lending) i.e. lending money to be repaid with interest

- Royalty-based i.e. funding in exchange for a share of future revenue.

What are some popular crowdfunding platforms in India for social and personal causes?

Some popular platforms include Ketto, Milaap, ImpactGuru, and Fueladream. For more details regarding this platform, refer to the above article.

Are global crowdfunding platforms available in India?

Yes, globally recognized platforms like Kickstarter and Indiegogo are also used in India.

Do crowdfunding platforms charge fees?

Yes, most crowdfunding platforms charge a percentage of the funds raised as a fee. The specific fee varies from platform to platform.