Imagine Nikita, a small-town student in India who applied for admission to a prestigious college in Australia. She applied to many other colleges, but to her surprise, she received a confirmation email from that Australian college. Now, Nikita, who has not gone out of India, has to calculate her living expenses, educational costs, and other factors for her student loan. Also, she has never applied for any loans, so she is clueless about where to begin.

If this story seems a bit similar to yours, then you have come to the right place. Here, we have put together an extensive guide to help students like Nikita to understand everything about education loan for Australia. We have also listed some of the popular banks and their study-abroad education loan scheme for your reference. We have even provided details regarding your cost of living in Australia as a student. So what are you waiting for? Scroll down below to learn more about different education loans for study in Australia.

Education Loan for Australia – Key Factors to Consider

There are many education loan providers that help you cover the cost of living in Australia, plus your educational costs. Picking the right education loan with a low interest rate and higher loan amount is crucial for every study abroad student. The key points to consider before getting any education loan for Australia are:

- Always check if your education loan covers medical insurance (OSHC Australia) expenses or not

- Confirm if the education loan service is scholarship adjustable* or not

- Would the loan still apply if the student gets a PR-Visa in Australia (permanent resident)?

- Check for Interest rates and Indian Government Education Loan Subsidy norms for Overseas Education need to be checked

*Scholarship Adjustable Loans are loans that allow students to pay margin money using their scholarship sum. Some banks require students to pay a percentage of academic fees along with a disbursed loan amount to prove financial viability. This percentage amount is called ‘Margin Money’.

Education Loan for Australia by Top Banks in India

Students can get education loans from banks in India when studying in Australia. Almost all the banks and NBFCs in India offer study-abroad loan programmes. To save you time and energy looking for these schemes, we have listed a few popular banks offering education loans for Australia below.

#1 SBI Global Ed-Vantage

Indian students who wish to pursue full-time courses in Australia or any other foreign country can take advantage of the SBI Global Ed-Vantage loan program. With this loan, you can afford courses, which usually cost close to ₹3 crores! The best part is that the SBI education loan for studying in Australia is sanctioned to you before you apply for your study visa. However, there is a catch: you need to pay ₹10,000 as a processing fee for this loan. Students who do not have collateral to pledge can also take advantage of this study in Australia loan. SBI offers up to ₹50 lakhs of unsecured loans under this scheme but for premier institutes only. Interested in learning more about the benefits of the SBI Global Ed-Vantage loan? Then, check the important points below.

- A maximum of ₹3 crore is granted as a loan.

- ₹50 lakh non-collateral loan is available under the SBI Global Ed-Vantage scheme.

- EMI repayment can be stretched up to 15 years

- Interest rate is between 9.65% to 10.15%

- The processing fee is ₹10,000

Also Read – SBI Education Loan for Abroad – Expenses Covered, Interest Rate & Application Process

#2 HDFC Education Loan for Foreign Education

If you find that your course fees and living expenses are overwhelming and you are not sure if any bank can help, don’t worry – HDFC Bank has got you covered! With the HDFC Education Loan for Foreign Education, you can get a study loan without limit. Keep in mind that you need equal-value collateral to get this loan. If you do not have collateral, then the maximum loan amount that you can get is ₹45 lakhs. You can learn more about the features of this loan by reading the points below.

- No limit secured education loan under the HDFC Education Loan for Foreign Education.

- Up to ₹45 lakhs of unsecured loans

- The interest rate is CBLR + Spread%, which changes depending on the risk factor.

- An origination fee of 1.5% + taxes on the loan amount is charged to students.

Also Read: HDFC Education Loan for Abroad – ROI, Interest Rates & Expenses Covered

#3 ICICI Bank Education Loan

Another great choice for Indian students who are pursuing a full-time course from Australia is the ICICI Bank Education Loan, which offers financial assistance up to ₹3 crore. Students who need up to ₹1 crore unsecured education loans for studying in Australia can consider this bank loan. For UG & PG courses, the repayment period is 10 to 12 years and 12 to 14 years, respectively. Check the points below for more details regarding this study abroad loan by ICICI Bank.

- Get a secured loan for study in Australia up to ₹3 crores.

- Collatera-free loans up to ₹1 crore.

- The interest rate for the loans starts from Repo* + 3.75% (Spread).

- 10 to 14 years of repayment period.

Also Read: ICICI Education Loan for Study Abroad – Benefits and Features

#4 Baroda Scholar Loan for Study Abroad

The Bank of Baroda is offering a study abroad loan with no upper limit as long as you show relevant expenses for your education! Students do not have to pledge any asset as collateral for loans up to ₹7.5 lakhs under the Baroda Scholar loan scheme. Also, no margin is charged for loans up to ₹4 lakhs. Students who are travelling to Australia or any other eligible country for vocational/technical studies can avail of this loan. More features & benefits of this loan are mentioned below.

- No processing charge or collateral is needed for loans up to ₹7.5 lakhs.

- No margin is charged on loans less than ₹4 lakhs.

- The education loan interest rate starts from BRLLR + 0.55%.

- There is no limit to the loan amount under the Baroda Scholar Loan for Study Abroad

Also Read: Bank of Baroda Education Loan – Key Information, Features and Benefits

#5 IDFC FIRST Bank’s Student Loan for Studying Abroad

IDFC FIRST Bank is one of the top private banks in India that offers loan schemes for students who want to pursue higher education in foreign countries like Australia. Students who have valid admission proof can avail study loans up to ₹1.5 crore with collateral. For unsecured loans, the IDFC FIRST Bank can grant up to ₹75 lakhs as a study abroad loan. The repayment tenure of the loan is 15 years. Up to 100% financing is available under this scheme, which also includes your travel costs. To learn more about the IDFC FIRST Bank’s Student Loan for Studying Abroad, check the important points below.

- Get secured loans up to ₹1.5 crore and unsecured loans up to ₹75 lakhs.

- NRI and Indian nationals can apply for loans

- Loans are processed even if admission is not secured (available only for selected institutes)

- Flexible loan tenure of up to 15 years

Also Read: Education Loan with No Interest

Expenses covered under Student Loan for Australia

Students often wonder what kind of expenses will be covered by the education loan for their studies in Australia. This is because living in India is much cheaper than living in Australia. That is why we have provided a list of expenses that are usually covered by education loans for Australia.

- Tuition Fee

- Travel Expenses (cost of flight is included)

- Cost of Books and Study Material

- Laboratory Fee

- Hostel Fee

- Purchase of a Laptop at a reasonable cost (if required)

- Expenses for Project Work or Study Tours

- Cost of insurance premium (if opted by the applicant)

Student Loans Australia Eligibility Criteria

Here is a list of detailed parameters that you must meet to apply for study abroad education loan schemes provided by Indian Banks and NBFCs.

- The applicant must be an Indian citizen

- Age must be between 16 and 35 years

- Pursuing graduation, post-graduation or doctoral studies in recognized universities in Australia

- Need a co-applicant who is earning well and has a positive credit history.

Education Loan for Australia Documents Required for Application Process

To make the process of loan application for your study in Australia smooth, you need to keep the required documents handy. For example, you need your passport for a Visa application, which you can not obtain on short notice. Thus, preparation beforehand is absolutely necessary for loan applicants. Listed below are the documents that you need to upload during the loan application.

- Academic records like your class 10, 12, or graduation results.

- Co-signers income proof

- ID proof like an Aadhar Card or PAN card

- Residential proof

- Confirmation of Enrolment (CoE) issued by a CRICOS (Commonwealth Register of Institutions and Courses for Overseas Students) for study in Australia

- IELTS Scorecard with 6.0 band in all sections or equivalent PTE Score Card

- Collateral documents for loan security (immovable property lease, ownership documents, society/builder NOC, Fixed Deposit Certificate, Government Bond Certificate, LIC Policy Certificate, etc.)

Also Read: Documents Required for Education Loan for Abroad Studies

Education Loan for Australia Application process

Students who want to study in Australia have two options: Indian Nationalised Banks (Private and Govt.) or Non-Banking Financial Banking Corporations (NBFCs) when it comes to getting an education loan. The application process for both is almost the same, and it involves close coordination with visa offices, international admission offices and bank authorities. Here is a step-by-step guideline for the Australian study loan application process.

- Choose a banking institution to get an education loan for studies in Australia.

- Apply for Education Loan by providing initial KYC documents, collateral documents and academic records.

- Get an electronic Confirmation of Enrolment (eCoE) from the University in Australia

- Get a Student Visa Subclass 500 application confirmation from the Australian embassy in India.

- Submit your documents to the banking institution and get a Loan Sanction Letter along with Signed agreement

- Submit the Loan Sanction Letter to the Embassy and complete other processes to get your Australian Student Visa

- Confirm your intake session details and fee payment schedule from the university by submitting the Australian Student Visa confirmation. Share these details with the bank to start loan disbursement

- Apply for the Indian Government Education Loan Subsidy Schemes from the Indian Banking Institution

Note: NBFCs and Private International Education Loans to Study In Australia are not eligible for any Indian Government Subsidy Scheme.

Education Loan for Australia – Living Expenses Calculation

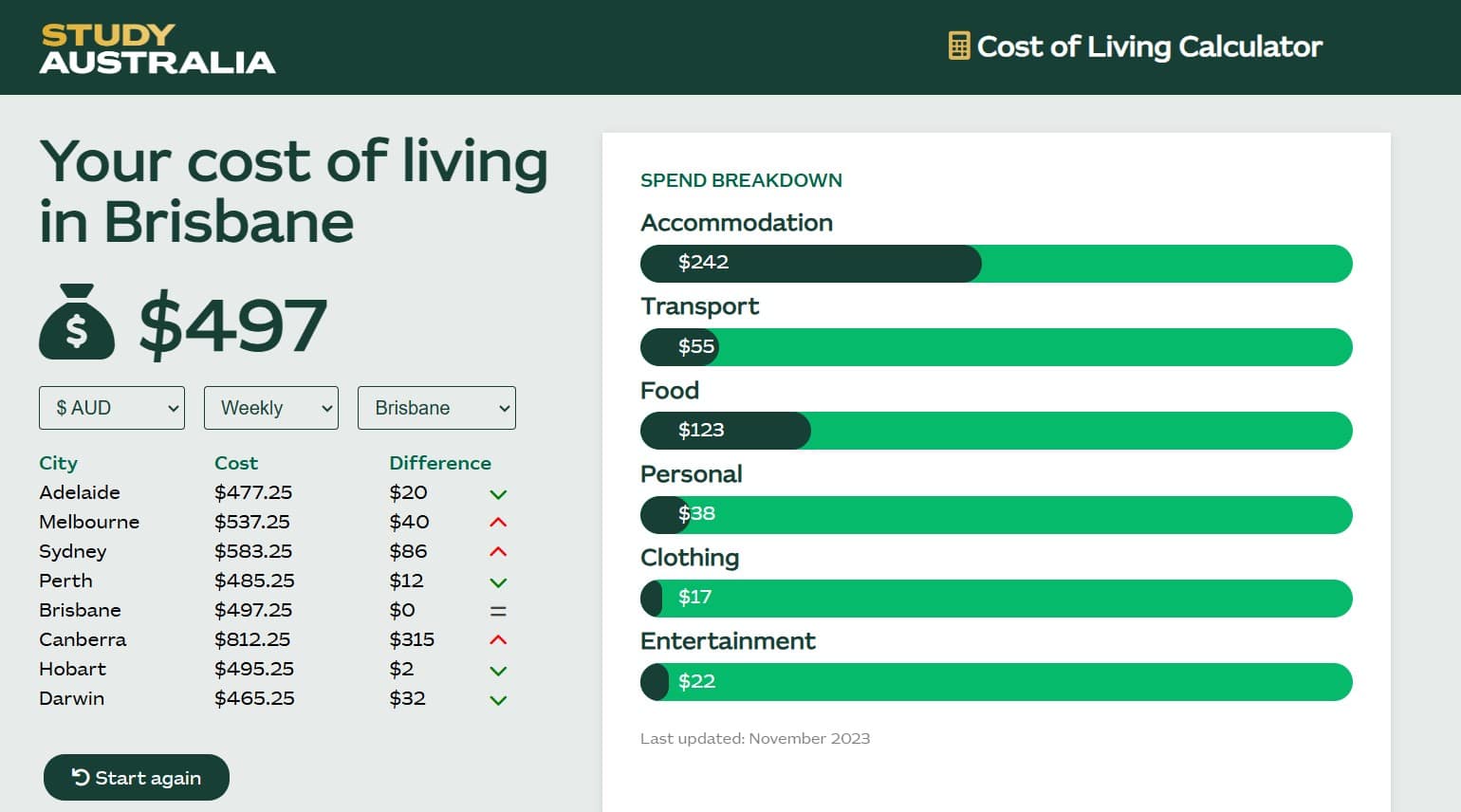

Students who are planning to apply for an education loan for their studies in Australia need to have a clear understanding of their day-to-day expenses. This will help the applicant to quote a much better amount to the bank for their loan. With the help of the Australian government’s official website called Study Australia, we have calculated the living expenses of a student below.

| City | Monthly Cost of Living |

| Brisbane | AUD 497 |

| Adelaide | AUD 477.25 |

| Melbourne | AUD 537.25 |

| Canberra | AUD 812.25 |

| Darwin | AUD 465.25 |

Education Loan for Australia FAQs

Q. How to get a student loan to study in Australia?

To get a student loan to study in Australia, you first need to meet all the eligibility criteria and then find a bank. Then, you need to fill out the application form and get the loan amount.

Q. Which bank is best for education loans for Australia?

Private and government banks are both good for education loans for Australia. You simply need to pick a bank which offers a sufficient amount that meets your educational needs.

Q. How much education loan can I get to study in Australia?

There are banks like HDFC Bank that do not limit the loan amount for studying abroad in Australia. Thus, depending on your educational needs, you can get a higher loan amount.

Q. Is Australian student loan interest free?

No, an education loan for Australia is not interest free. In fact, no education loan is interest free because this is how banks make money. Even with the CSIS Scheme by the government of India, you can get a subsidy on Simple Interest that is accrued during the moratorium period but after that, you need to pay full interest.

Q. Can I take 2 education loans for study in Australia?

Yes, you can take two education loans to study in Australia if one loan is not sufficient to fund your educational journey. However, you must meet the eligibility criteria of the bank or NBFC where you are applying for a second education loan.