According to the 2011 census study, only 72.19% of Assamese are considered literate, and a majority of them have not completed their higher education. In a move to increase the literacy rate and promote higher education among the young generation, the state government of Assam, during the budget speech 2016-17, announced that they would offer education loans at a discounted interest rate for the children of all active government employees. This study loan scheme is called the Bidya Lakshmi education loan scheme.

Meritorious wards of government employees of Assam who want to study abroad or in India but can not do so due to financial problems can get the help of up to ₹10 lakhs from the Bidya Lakshmi Education Loan scheme. The state government subsidizes the interest rate; male students need to pay only 4% interest, while female applicants are offered loans at a 0.5% lower interest rate compared to male students. If you are interested in learning more about the Bidya Lakshmi Education Loan, then read this comprehensive guide below.

Bidya Lakshmi Education Loan Highlights

| Particulars | Details |

| Name of the Scheme | Bidya Lakshmi |

| Launched by | Government of Assam |

| Official Website | sivasagar.assam.gov.in |

| In association with | State Bank of India |

| Beneficiaries | Children of active Assam government employees |

| Eligible Courses | Professional technical courses, graduation and doctorate programs, courses conducted by CIMA and CPA in India and abroad |

| Benefits | Education loans up to ₹10 lakh |

| Moratorium Period | Course period + 1 year |

| Mode of Application | Online and offline |

Bidya Lakshmi Education Loan Benefits

- Wards of Assam state government employees can avail of this education loan.

- State government employees whose income exceeds ₹4.5 lakh can get a loan up to ₹10 lakhs.

- Bidya Lakshmi Education Loan covers all expenses regarding the applicant’s education.

- The student loan covers the travel expenses of students studying abroad.

- Bidya Lakshmi loan is provided to the student and their parents jointly, and it will be disbursed directly to the college’s account.

- No margin amount is charged by the bank for facilitating this education loan.

- The student who receives this loan is covered under the Rinraksha SBI Life Insurance Policy.

- Students who already have insurance and are using the loan amount to pay the EMIs will be provided with an SBI life insurance policy specifically for paying off the loan in unforeseen situations.

Bidya Lakshmi Education Loan Amount

The Assam government, through SBI, offers this loan of ₹10 lakhs to students who want to study in India and Abroad.

- Studies in India – Maximum of ₹10 lakhs

- Studies Abroad – Maximum of ₹10 lakhs

Bidya Lakshmi Education Loan Eligibility Criteria

Applicants must meet some specific criteria to be eligible for the Bidya Lakshmi education loan scheme. The required eligibility conditions are as follows:

Eligibility Criteria for Students

- A student must be a ward/child of a regular employee of the Government of Assam presently in service.

- He or she must have secured admission in one of the professional technical courses listed above.

- A student who has failed the last qualifying examination, including class 12, will not be considered eligible.

Eligibility Criteria for Parents

- A parent must be an employee of the State Government of Assam with a *check-off facility.

- He or she should have at least 5 years of pensionable service left.

- His annual income must be ₹4.5 lakhs or less.

- He or she is ready to repay the loan even if his or her ward/children fail to secure a job after completing the course.

- In case of retirement during the currency of the loan, he or she will opt to draw a pension through SBI until the loan is liquidated or paid.

Note*: The check-off facility is an arrangement where the borrower’s employer agrees to deduct an EMI of the loan amount directly from the borrower’s salary. This is done through a tri-party agreement between the bank, employer, and borrower, with the employer undertaking the responsibility of deducting the EMI from the salary.

Also Read: Education Loan Eligibility Criteria – Complete Guide for Students

Bidya Lakshmi Education Loan Security

Unlike traditional education loans offered by banks, applicants do not have to pledge any collateral asset in the form of security. However, the student’s guardian, who is an Assam government employee, must be a co-signer on the loan and must take responsibility for repaying the loan along with the student.

Also Read: What is a Collateral? – Understanding its Meaning, Purpose, Types and Importance

Bidya Lakshmi Education Loan Interest Rate

For loans under the Bidya Lakshmi Education Loan, the interest rate is MCLR + 1%. In addition, the girl child will get a rebate of 0.5% in the interest rate. The Assam government will provide subsidies to the students under the Bidya Lakshmi Education Loan scheme to keep the interest charged to students under 4%. In addition, if a recipient of the loan starts paying EMIs during the moratorium period, then they will get a rebate of 1% at the time of loan closure.

Did You Know? – The marginal cost of fund-based lending rate (MCLR)* is a benchmark rate utilised by Indian banks to determine the interest rates for different types of loans. This indicates the benchmark interest rate used by the bank for determining the interest rate (1%) on loans up to ₹10 lakh. The effective rate of interest (ROI) will not be below the 1-year MCLR at any point in time.

Also Read: Education Loan with Low Interest Rate

Bidya Lakshmi Education Loan Approved Courses and Colleges

Students need to pursue courses which can result in jobs or the potential to build a business to get financial help through the Bidya Lakshmi Education Loan. The terms & conditions of this loan scheme clearly state which course you can pursue to get this loan, and details regarding this are mentioned in the tables below.

List of Approved Courses in India Under Bidya Lakshmi Education Loan

| Professional Courses |

|

| Courses Conducted By |

|

| Others | For studies at institutions identified under scholarship loan |

Bidya Lakshmi Education Loan Approved Courses for Study Abroad

| Graduation | Job-oriented professional/technical courses offered by reputed universities |

|

Post-Graduation |

|

List of Eligible Institutions Under Bidya Lakshmi Education Loan

Courses conducted by colleges/universities approved by UGC/AICTE are eligible for the Bidya Lakshmi Education Loan. There are a total of 112 approved and listed premiere institutions under this education loan scheme. This list contains all IIMs, all IITs, and some premier institutes like:

- ISB Hyderabad

- ISB Mohali

- XLRI Jamshedpur

- MDI Gurgaon

- MDI Murshidabad

- BITS Pilani

- BITS Goa

- BITS Hyderabad

- IIFT Delhi

- IIFT Kolkata

- IIIT Delhi

- IMI New Delhi

- IMT Ghaziabad

- NITIE Mumbai

- NMIMS Mumbai

- S P Jain Mumbai

- SCMHRD Pune

- SIBM Pune

- XIM Bhubaneswar

Students can click here to get the complete list of institutes approved under the Bidya Lakshmi Education Loan.

Expenses Covered Under Bidya Lakshmi Education Loan

When applying for a Bidya Lakshmi Education Loan, you need to justify each and every expense for your education for which you are asking for the required loan amount. That is why you need to have a clear understanding of which expenses are considered under this loan scheme. This will help you avoid loan rejection in case you ask for something that is not covered by the loan.

- The college fees as per the documents shared.

- Hostel fees, if the student opts for a hostel, are not included in the course fees.

- If a student gets admission through management quota, then the fees for seats approved by the State Government/Regulatory Body for courses will be provided.

- Examination, library, and laboratory fees are also covered in the loan.

- For studies abroad, travel money, which also includes flight ticket costs, will be covered by the loan.

- For study in India, the travel cost of the hostel to college and vice versa will be covered by the loan.

- The loan amount can be increased for the purchase of books, equipment, instruments, uniforms, etc.

- You can also buy a computer at a reasonable cost for course completion using the loan amount, which is subject to 20% of the full amount of the total tuition fee for those who do not receive any concessions/remissions.

- This loan also covers the caution deposit/building fund/refundable deposit. Remember that it is subject to 10% of the tuition fees for the entire course.

- For PhD courses in India/Abroad, the loan amount will be calculated after factoring in the Scholarship/Fellowship/Honorarium amount.

- The student’s insurance premium will also be covered by the loan.

Also Read: Top Reasons to Apply for an Education Loan

Bidya Lakshmi Education Loan Processing Fees

Under the Bidya Lakshmi Education Loan scheme the bank does not charge any processing fees or upfront fees from students. However, in case of study abroad student loans, the following conditions will apply:

- Loans of more than ₹4 lakhs require a deposit of ₹5,000.

- A banker’s cheque payable to the bank in the name of the borrower will be drafted using this amount and it will act as a margin for the loan.

- In case margin is not applicable, the amount will be adjusted against the payable interest on the loan.

Also Read: Factors to Consider Before Applying for an Education Loan

Bidya Lakshmi Loan Application Process

To apply for the Bidya Lakshmi loan scheme, applicants must follow the steps listed below:

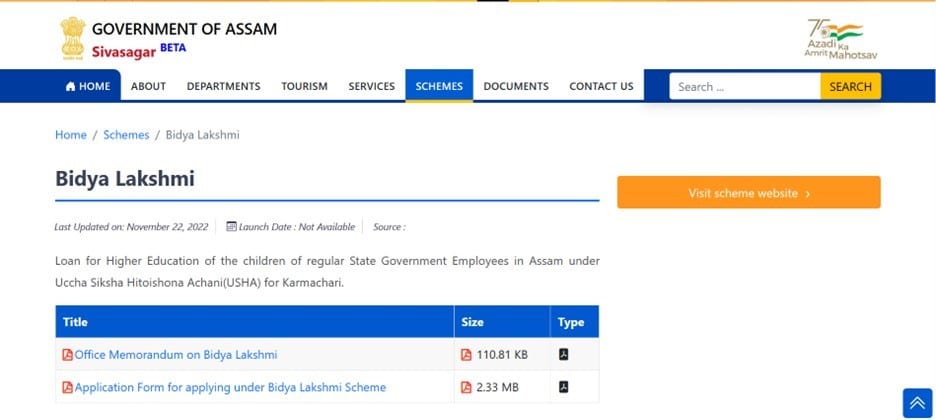

Step 1 – Visit the official website of the Assam Government (sivasagar.assam.gov.in)

Step 2 – Navigate to the ‘Scheme’ option at the top of the screen.

Step 3 – Click on the ‘Bidya Lakshmi’ option.

Step 4 – Navigate to the ‘Application form’ and click to open it.

Step 5 – A new window will open with the application form.

Step 6 – Read the given details related to the scheme carefully and download them.

Step 7 – Fill out the form with the required information and prepare all the necessary documents in the prescribed format.

Step 8 – Submit the application form along with the documents at the designated SBI branch to complete the application. (To understand how the loan application is processed after your application, you can click here.)

Note: The Assam government has approved the following 70 designated bank branches in Assam for sanctioning education loans. Click here to get the list of all the SBI branches for loan application.

Also Read: How to Apply for an Education Loan

Documents Required for Bidya Lakshmi Education Loan Application Process

- Three copies of passport-size photographs of the applicant and the parent.

- Photocopy of the PAN card of the applicant and their guardian

- A copy of your electricity bill/Aadhaar card/driving license/passport/postpaid telephone bill is required for proof of address.

- Marksheets and certificates from Class 10 to recent education.

- Admission letter for the current course.

- A prospectus of the current college and a copy of approval from the valid authorities are needed.

- Score sheet of entrance tests like JEE/PMT.

- A detailed course fee structure is on the institution’s letterhead.

- Photocopy of the bank passbook or bank account statement (For Parents Only)

- Income proof of the guardian (Form 16/Income Tax Return/Income Certificate from Appropriate Authority).

Note:- Students applying to study abroad must bring their passports, unconditional offer letters and the documents listed above to apply for the scheme.

Also Read: Documents Required for an Education Loan – An Extensive List

Bidya Lakshmi Education Loan – FAQs

What is the applicable interest rate for Bidya Lakshmi loan in Assam?

The applicable rate of interest for Bidya Lakshmi Education Loan in Assam is approximately 4% for male candidates and 3.50% for female candidates.

How will the Bidya Lakshmi Education Loan amount be disbursed?

The Bidya Lakshmi Education Loan amount will be disbursed directly to the educational institutions.

Can I get a 100% education loan in Assam under Bidya Lakshmi Education Loan scheme?

Yes, the students can receive 100% education loans depending on their needs. The Bidya Lakshmi Education Loan offers 100% financing for educational purposes.

Can I avail Bidya Lakshmi Education Loan without having any co-applicant?

Students must need a co-applicant, who can be a parent or guardian to avail the Bidya Lakshmi Education Loan. The co-applicant must have an Assam government job.

What is the minimum salary parents are required to apply for Bidya Lakshmi Education Loan?

To be eligible for applying for Bidya Lakshmi Education Loan, the income of the parent must be sufficient to cover the education loan EMI in case the student is unable to pay.

What is the difference between Bidya Lakshmi Education Loan and Vidya Lakshmi?

Bidya Lakshmi Education Loan is a scheme by the Assam state government for the wards of their employees. However, Vidya Lakshmi is a central government student loan application portal which helps students apply for loans from multiple banks using a single application.

What is the maximum loan amount under the Bidya Lakshmi scheme?

Applicants can get a maximum of ₹10 lakhs education loan under the Bidya Lakshmi scheme by the Assam government.

Which courses are approved for Bidya Lakshmi education loan?

Courses after Class 12 which are offered by any recognised college or university in India or abroad are eligible for Bidya Lakshmi education loan scheme.

Can I pay my health insurance premium using the Bidya Lakshmi scheme during the course duration?

Yes, your health or life insurance scheme premium is covered under the Bidya Lakshmi scheme during the course duration.

How long is the Bidya Lakshmi education loan scheme moratorium period?

The moratorium period for Bidya Lakshmi education loan is the course duration plus one year after the course completion.