The Assam Abhinandan Education Loan Subsidy Scheme is a flagship initiative by the Government of Assam designed to provide financial relief to students pursuing higher education. This scheme offers a one-time subsidy of ₹50,000 on education loans, helping students and their families manage the burden of repayment.

Launched on September 5, 2024, by Chief Minister Himanta Biswa Sarma, the scheme reflects the government’s commitment to making higher education more accessible. It is managed by the Assam Finance Department and is open to students who have taken education loans exceeding ₹1 lakh from recognized banks. This article delves into the key aspects of the scheme, including its objectives, eligibility criteria, application process and benefits, providing a complete guide for aspiring applicants.

Assam Abhinandan education loan subsidy scheme key features

Listed below are the key features of the Assam Abhinandan Education Loan Subsidy Scheme, an initiative by the Government of Assam aimed at reducing the financial burden on students pursuing higher education.

- One-time subsidy of ₹50,000 on education loans.

- Direct credit of subsidy to the loan account.

- Students can apply for the subsidy by paying 25% of their loans

- Applicable for education loans taken from recognized banks.

- Supports students across various educational streams.

- Simplifies loan repayment for families facing financial burdens.

- Promotes higher education and reduces financial constraints.

Objective of the Scheme

Listed below are the objectives of the Assam Abhinandan education loan subsidy scheme:

- Encouraging students to pursue higher education without financial stress.

- Reducing loan repayment burdens on families.

- Promoting professional and technical education.

- Supporting students from economically weaker backgrounds.

Eligibility Criteria

Below are the eligibility criteria for the Assam Abhinandan Education Loan Subsidy Scheme. Applicants must meet these requirements to qualify for the one-time subsidy.

- It is mandatory for the student to be a permanent resident of the state of Assam.

- The student must have taken a loan from a commercial or rural bank.

- The bank has to be recognized by the Reserve Bank of India.

- The benefit of this scheme can be availed only as a subsidy on education loans.

- It is mandatory for the student’s parents to have an education loan of more than Rs 1 lakh.

Documents Required

Listed below are the documents required for the Assam Abhinandan Education Loan Subsidy Scheme. Applicants must submit these documents to verify their eligibility.

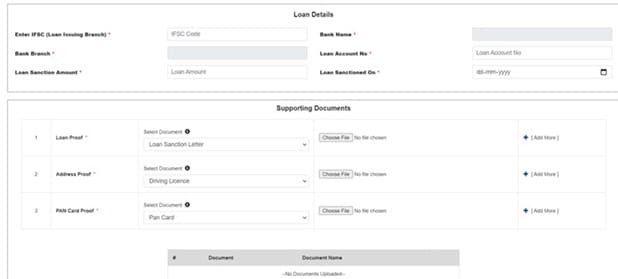

- ID proof (Student’s Aadhaar card)

- PAN card

- Residential proof

- Proof of availing an education loan

- Loan sanction letter

- Loan account passbook

- Loan statements

- Residence certificate

How to Apply?

To apply for the Abhinandan Loan Scheme, candidates must follow the steps mentioned below:

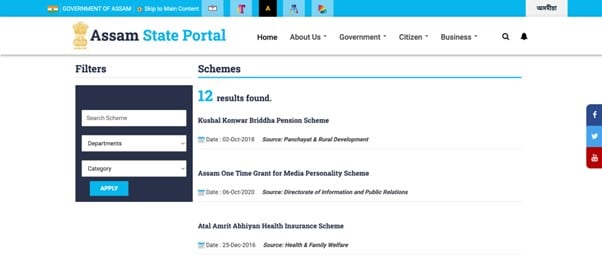

- Visit the official website of the Assam Government at assam.gov.in.

- Click on the ‘Schemes‘ button to proceed.

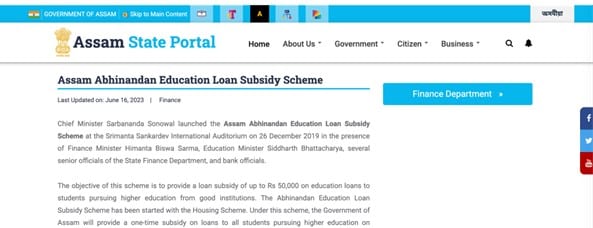

- Scroll down on the page to locate the ‘Abhinandan Education Loan Scheme‘ and click on it.

- Now, click on the ‘Finance Department’ button on the right-hand side of the screen.

- Follow the instructions and proceed to apply for this education loan scheme.

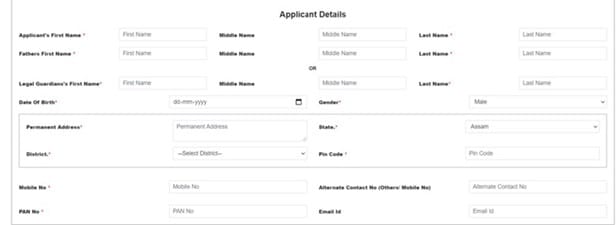

- Complete the online application form for the scheme by providing the necessary information and uploading the required documents, including:

- Applicant name

- Father’s name

- Date of birth

- Complete address

- Mobile number

- Pan Card details

- Bank details

- Click on the ‘Submit’ button to complete the application process.

Education Loan Subsidy Schemes Provided by the Government of India:

- Central Sector Interest Subsidy Scheme(CSIS)

- Dr. Ambedkar Interest Subsidy Scheme

- PM-Vidyalaxmi Scheme

FAQs

Can students from outside Assam apply?

No, only permanent residents of Assam are eligible for this scheme.

How much subsidy is provided under this scheme?

A one-time financial assistance of ₹50,000 is credited directly to the loan account of the beneficiary.

Who is eligible for this scheme?

Students who have taken education loans from recognized banks and meet the government's eligibility criteria can apply.

What is the format to upload supporting documents?

The supporting documents must be in JPG, JPEG, PNG, or PDF format, and the file size of each document should not exceed 2 MB.

Where can I apply for this scheme?

Students can apply through the official Assam government portal: dids.assam.gov.in.